Latest inflation statistics: tuition inflation rises to +2.6% in 2024

Tuition growth came in very close to general economy-wide inflation of 2.7%

Before beginning a review of inflation statistics, I want to urge all students and parents who have taken on significant amounts of educational debt to focus on their post-graduation financial health - as soon as possible.

There are massive changes going on with the federal government these days – I’m sure you’ve seen that all over the news and social media – and one of the areas the new administration is turning its eyes on is the Department of Education. Some of you will have borrowed hundreds of thousands of dollars from the Dept of Ed. (The average medical student for example graduates with over $234,987 in debt, much of it federal.) There are several debt repayment programs which, if you enter them now, may be able to put a cap on the amount of money you will repay the government during your career. Participation in these repayment programs can be a very valuable asset.

But the new administration is seriously considering transferring the nearly $2 trillion portfolio of student debt to the Department of the Treasury. Treasury may have very different priorities in managing that debt and collecting on it than the Department of Ed. In a convulsed DC, the repayment programs may get halted with new entrants blocked. There is also proposed Republican legislation that would alter how the federal government funds college debt in significant ways, another factor in the policy landscape.

Act now. Everyone’s situation is different, so a personalized approach meant to help you needs to be developed.

Reach out to me or another qualified advisor about the federal debt repayment programs and whether they are a good fit for you.

And if you are the parent of a professional student worried about your child’s debt load, I am happy to talk to you, too.

Schedule a time with me at this link. I think you’ll like what you hear.

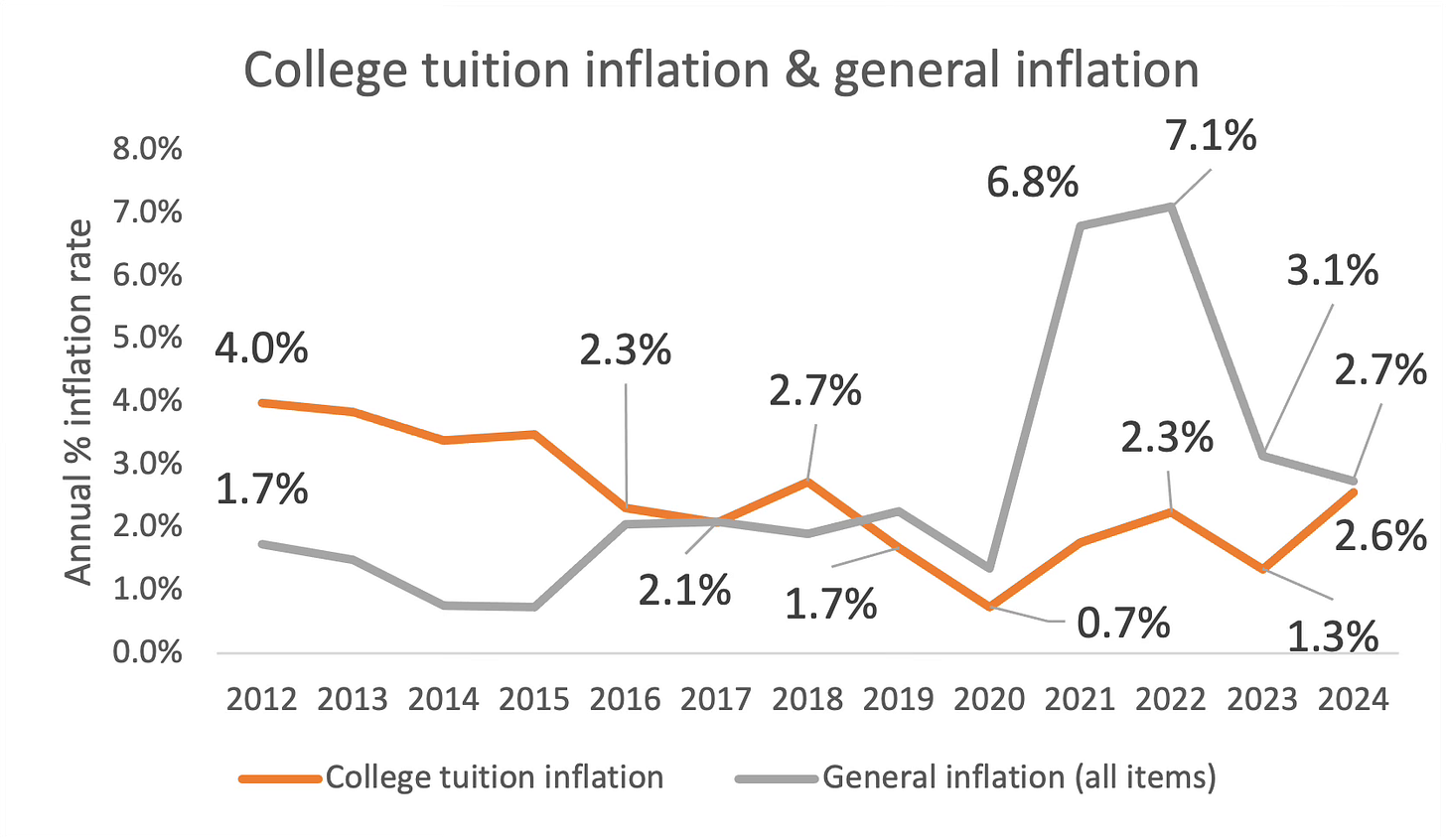

I had been very curious to see the final Bureau of Labor Statistics (BLS) college tuition consumer inflation print for 2024, after revisions, because my anecdotal impression working directly on aid awards was that college inflation was accelerating. For example, one satellite campus of a prominent northeast flagship university boosted its cost of attendance by close to 15% (!) between 2023 and 2024. Would the generalized information compiled by the government come anywhere close to that elevated figure? The answer is no, but students did see a quicker rise in net costs than in the last few years. The latest BLS data on consumer inflation breaks down consumer inflation by components, coming in at a 2.6% rate for college tuition, very close to the general 2.7% rate for the overall economy. The 2.6% compares to 1.3% in 2023 and 2.3% in 2022.

Stepping back to look at the general picture, college inflation had been slowing – dis-inflating -- for years until 2020 and the arrival of COVID. In fact, college inflation has fallen below the general inflation rate since 2019, with 2024 marking the 6th successive year that college decreased in price in inflation adjusted terms. While college inflation rose fairly quickly in 2022, the 2.6% rise this year took place in a more normalized economy.

Bureau of Labor (BLS) Statistics CPI (Urban consumers and the Tuition component of this same CPI index). The tuition component represents 1.3% of the overall price index. For comparison, this is about the same weight as cellular service bills. Annual data with the final number representing trailing twelve months data to December 2024, not seasonally adjusted. A side comment: CTAS research, which uses Dept. of Education data, is aligned with the BLS data after 2015 but found lower tuition inflation rates beginning in the Great Recession of 2008/2009, so we believe the slowdown in college cost increases began earlier than the BLS surveys indicate.

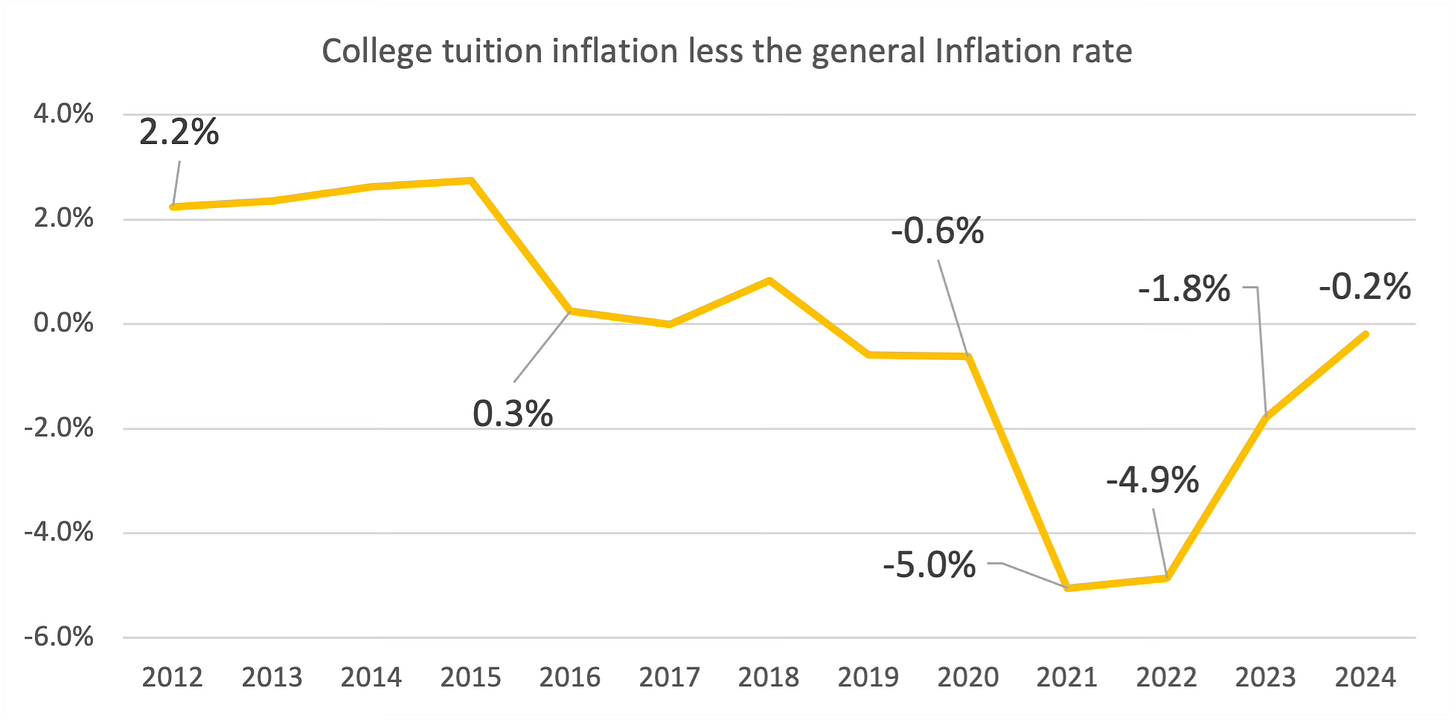

The second chart below shows the divergence between the general inflation index and the tuition component. Divergences in 2021, 2022 and 2023 were so wide that severe budget issues in higher ed looked to be arriving. One piece of good news to emerge from the 2024 data is the closing of this gap and, if the trend persists, we can expect colleges to begin covering the inflation in their own costs with equivalent price increases. This is especially important because the federal government’s large fiscal subsidies of universities made to compensate for the difficulties of the COVID period are disappearing in the rear-view mirror.

Bureau of Labor (BLS) Statistics CPI (Urban consumers and the Tuition component of this same CPI index). BLS calculates both unadjusted and seasonally adjusted figures. Though the BLS seasonal adjustment is consistent with past years, I opt to focus on unadjusted figures to get closer to the fundamental data.

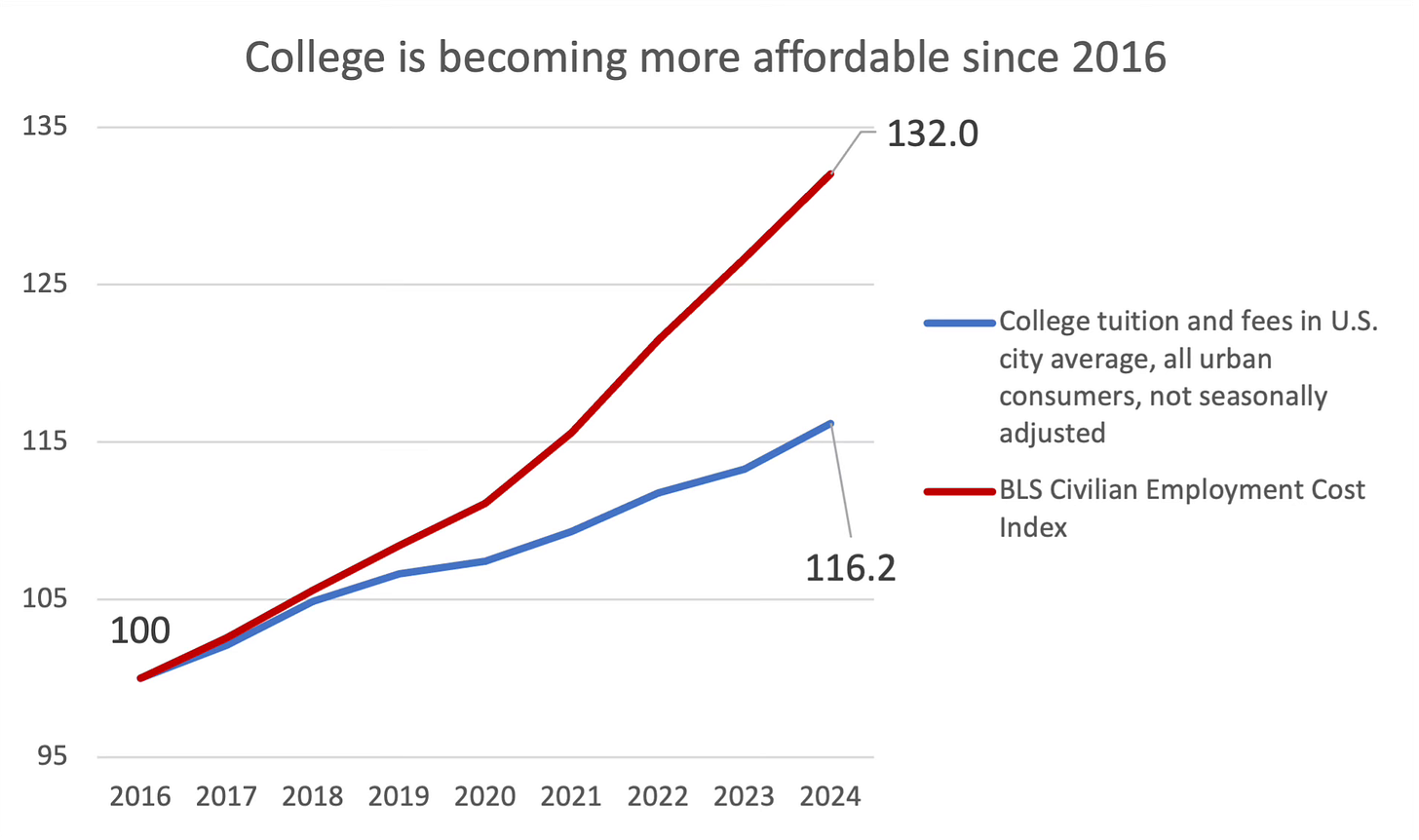

How do these inflation figures compare to how much Americans earn at work? The most recent figures from the BLS employment cost index showed growth of 4.2% in wages and income in 2024. With wage income representing a significant piece of the Student Aid Index (SAI), one would logically have expected that 4%+ growth to feed into college pricing. Just as in every consecutive year since 2016, this fairly robust wage growth was not matched by equal strength in college pricing. The divergence between the traditional SAI (and its predecessor the Expected Family Contribution) and income from work continues to support the position that market pricing – as opposed to statutorily-determined financial need - is becoming more and more important in tuition price setting and financial aid.

Because roughly ¾ of US undergrads attend public universities, it’s difficult to imagine how this income/SAI disconnect would spring only from private college students. Market pricing apparently is becoming more extensive in public universities.

The budgetary impact of slow tuition rises can be mitigated by enrollment gains. The good news is that undergraduate program enrollment is finally rising and recouping the losses from COVID, as seen in the most recent NSC data, with 4.5% growth in enrollment reported in the Fall of 2024 v 2023. This rise, as has been reported, primarily benefited community colleges and for-profit institutions, but public and private non-profit 4-years still showed solid gains of 3-4%. Putting the enrollment and price trends together, higher ed is doing ok economically. One positive takeaway is that 2024 looks much better than the very worrisome COVID period, when both enrollment and price trends were just plain bad.

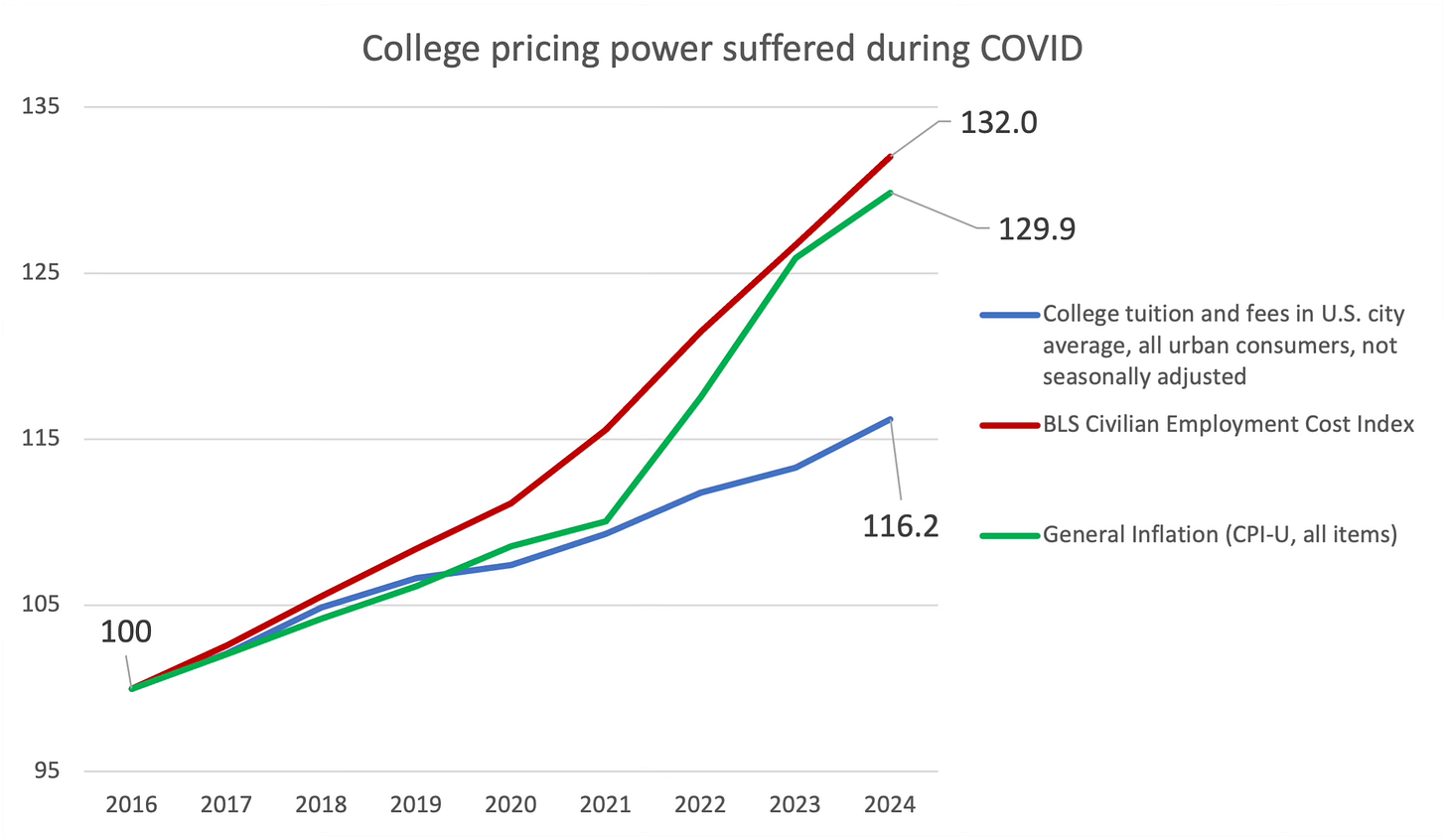

Another way to illustrate how COVID forced the federal government to intervene financially is to trace wage growth and college inflation against general inflation across the economy. No matter one’s views on how commercial or purely public minded the university system should be, we can all agree that colleges need to be able to cover their costs to survive. 2024 saw the pace of revenue gains vs inflation normalize. In the future, will the higher ed system be able to close the gap that opened in the pandemic?

This material is intended for educational purposes only. You should always consult a financial, tax, or legal professional familiar with your unique circumstances before making any financial decisions. Nothing in this material constitutes a solicitation for the sale or purchase of any securities. Any mentioned rates of return are historical or hypothetical in nature and are not a guarantee of future returns. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost. Avise Financial Cooperative, Inc. is a registered investment adviser with the SEC. Registration of an investment adviser does not imply a certain level of skill or training.