Net Price and Its Discontents

Net Price is a gamed metric that needs to be improved

Any metric viewed as important will be gamed.

“Any observed statistical regularity will tend to collapse once pressure is placed upon it for control purposes.” – Charles Goodhart, 1975

Requiring Net Price reporting by college undergraduate programs by the US Department of Education was a key step forward in helping college pricing become more transparent. Including all costs associated with full-time, on-campus enrollment, subtracting any aid, and excluding any loans from the picture came to a result was closer to what a consumer would typically consider a true commercial cost. This metric countered an emerging confusion about what college truly costs driven by increasing tuition discounting and opaque Federal grant calculations within what was a complex ecosystem of higher ed products.

When a metric is viewed as important – in Goodhart’s language, “pressure is placed upon it” – it is often gamed – it “collapses” – as we so often see in business measurement. This shows in how the Net Price metric was designed and formulated. At every turn, its design leads to prices lower than they are in actuality. This in turn suggests that colleges and regulators made behind-the-scenes choices when implementing Net Price, gaming it to present results that improved appearances. In the end, this made advertised Net Price numbers less relevant to students and families and lowered the publicized number. These reported Net Price metrics have usefulness, but a limited usefulness.

This has led CTAS to develop Net Cost. Net Cost is a consumer-centric metric which presents costs as they are seen in commercial transactions outside of higher education, while broadening the Net Price metric to cover more students. Like Net Price, Net Cost represents a full-time student’s cost of attending college including: tuition, room & board, fees and estimates of supplies, less institutional aid of all kinds (including need-based and merit), and less federal and state/local aid. Loans and other repayable amounts are excluded and do not reduce the cost. Room and board charges used are on-campus costs for residential colleges; for students attending non-residential institutions, the college's own estimate of such off-campus costs is mostly used.

Net Price has defects both in its design and then in practice. Net Cost improves upon these defects to attain a more inclusive picture of college pricing.

Net Price by design excludes 30% of entering students

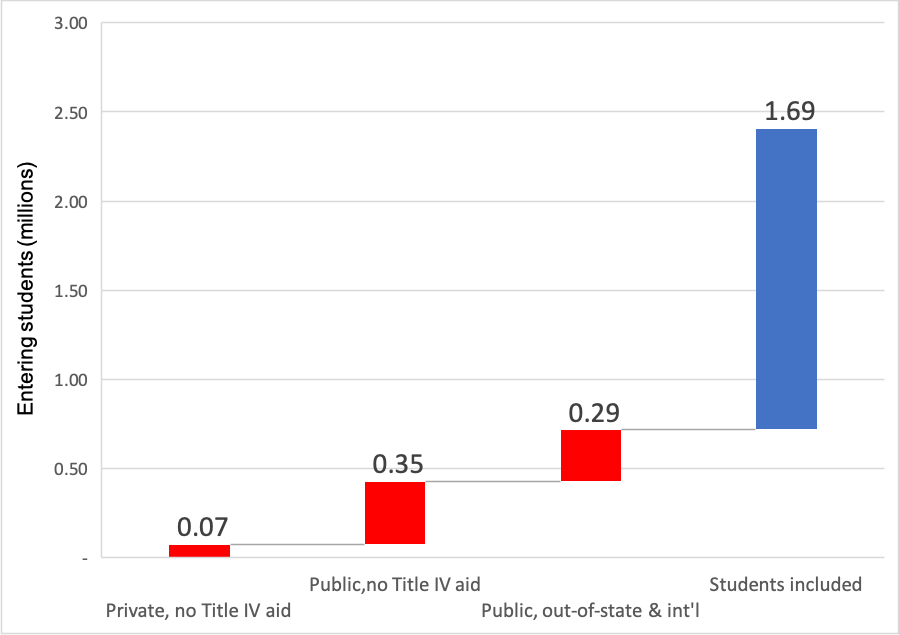

By design, Net Price reporting by public colleges excludes all out-of-state students and those not receiving aid or loans from the government or the college itself; and reporting by private schools excludes the latter category, those not receiving aid or loans from the government or the college itself. The logic behind this selection is not readily clear, at least to us. Provisional 2018/19 numbers show these assumptions exclude from consideration 30% of an entering class numbering 2.41 million full-time students.

In practice, almost half of the entering class is excluded from Net Price reporting

However Net Price was designed, actual reporting leaves even greater number of students out. Net Price tallies for private and public colleges in 2018/19 show that only 57% of entering students are included and 43% excluded; public colleges include even fewer, only 54%. Almost half of all students are left out of the calculation.

Out-of-state students and students not receiving federal aid such as Pell grants tend to be wealthier than those who do. Excluding those students, who generally pay more to attend a college, thus depresses the average Net Price and conceals the true cost of college.

The latest numbers are outdated

As of right now, publicly-available 2018/19 provisional reporting contains 2017 Net Price numbers. So we are at the very end of 2020 and the numbers we have are about three years old. While the COVID-19 pandemic and recession seem to have flattened college inflation, making that delay less significant as of right now, that gap in information can often have significant consequences. To select a timespan equivalent to 2017 and the approaching 2021 academic year, the period between 2014 and 2017 saw an 11% increase in CTAS’ average Net Cost index. The delay in reporting in an inflationary environment depresses publicized prices compared to what they are now.

Only entering students are included

The figures quoted above are for the entering class. Pricing picture for students after that first year is murky. Considering full-time students only, as reported, data on just 1.4 million students are used to calculate a Net Price intended to cover a total US 2019 full-time undergraduate enrollment of 10.3 million, with a further 6.4 million part-time students affected. While the Dept of Education does require reporting of the total amount of aid granted the entire undergraduate population, the way that metric is designed obscures what a college grants in institutional aid to its entire undergraduate body.

Price discrimination by income

Complex price discrimination by colleges makes the average Net Price number even less useful for prospective students, as prices are determined partly by a student’s family finances along with academic and demographic factors, and by the decisions of enrollment offices. Reporting of average net prices is fine – all businesses price discriminate and almost all of them nevertheless pay close attention to their average realized price – but as a consumer tool, it is only somewhat useful in many higher ed situations.

The Net Price rules of course require reporting by income bracket. Here again, higher education’s most renumerative business segment – the well-off – is clouded by the Net Price design. The topmost income bracket of $110k for Dept of Education reporting is indeed greater than the average US family income of $80,305 (2018) but it is about equal to the median for such families where one member has at least a Bachelor’s degree ($111,415). This last category, families who have attained a Bachelor’s, would logically be the base customer segment for undergraduate programs. Of the 49 million families with a head of household older than 25, 17 million of them or 35% of the total, have an income above $110k. The Net Price by income reporting thus cuts off a significant part of undergraduate enrollment and, again, those tending to pay the highest prices.

All figures are from the 2018 US Census Current Population Survey.

Reported average Net Price is especially misleading at highly selective colleges

The Net Price metric works better for certain types of school than others, as one would expect given the great variety of educational programs. It maybe best serves regional 4-year colleges, where a large majority of students receive title IV or institutional aid, attend full-time and live on or near their colleges. For community colleges, one practical weakness is that Net Prices for students who live off-campus include college estimates of off-campus living. Many such off-campus estimates are developed carefully: Maryland’s community college network has clearly studied and coordinated institutional reporting of off-campus pricing. But many other estimates from nearby schools show inconsistencies, as academic studies show. And commuter students often incur few extra living expenses for attending college, because they live at home during the program.

One particularly misleading use of average Net Price is by the high-profile group of the most highly selective colleges. This set of schools accepting <10% of applicants displays a persistent disparity between their reporting average Net Price and the actual average Net Cost, mostly because students receiving no aid are excluded. If all students are included in the 2017 calculation, Net Price and Net Cost show a discrepancy just short of $25k.

The table below shows these schools. As a group, nearly half of their students receive no discounts from the college or government non-repayable aid. Because these schools have large endowments and are reluctant to negotiate on price with accepted applicants, this group of students will come from well-off families able to afford the listed cost of attendance of >$65k. From a business viewpoint, this $25k difference between Net Price and average Net Cost — the true average amount the entering class of students pay — really only shows a high level of price discrimination. But from a consumer perspective, Net Price numbers sometimes highlighted by these colleges are perplexing. How can students and their parents know whether they will pay the full list number or the lower Net Price? Highly selective schools can and do use the Net Price metric to convey greater affordability than is really the case.

Net Price reports use inconsistent calculations

While the Department of Education has laid down principles and rules for calculating Net Price, these rules are applied inconsistently. This lack of accounting clarity can only further confuse consumers. We will highlight two examples from the 2017 reporting cycle to illustrate the problems. Without needing any access to the internal books of the colleges involved, discrepant practices are apparent.

The Illinois community college network in our view uses a calculation method that is outside the norm for the industry and results in some perplexing calculations. We can use the Illinois Valley Community College, a small school located in Oglesby in the center of the state, as an example. In 2017, the school had a full Cost of Attendance (listed tuition along with estimates of housing and supplies) of $19,400 and entering students, almost exclusively in-state, received a bit over $2,000 per person in grants & discounts, the largest portion of that being Pell Grants. That means that, in layman’s terms, entering students paid approximately $17,000 a year to attend full-time, including living costs. But Illinois Valley reported an average Net Price of $5,929 with a sliding scale of prices ascending to $11,082 for the students in the topmost tier, very different from $17,000. Whatever the exact cause of the difference, these results are confusing. Similar pattern and practice can be seen throughout Illinois community college IPEDS reporting but not in most institutions elsewhere.

A perhaps even more glaring example is Howard University in DC. In 2017, Howard reported Net Prices by income spanning $37,167 for the lowest income group to $42,189 for the highest. Yet their Average Net Price listed was $19,196, below the entire range of costs. CTAS’ calculation of the school’s Average Net Cost for the year is $30,839 based on raw totals. We don’t know how to reconcile any of these numbers. And just to confirm, almost all colleges report Average Net Price lying within the bounds of the Net prices by income level, logically, so Howard’s reporting is outside of industry standards.

Solutions

A better metric: Average Net Cost is the better mousetrap. Net Price is not representative of the full undergraduate body, either for the entering class or for all years of the program, it artificially depresses the reported price number by excluding wealthier students who tend to attend out-of-state institutions or who do not receive aid, and it is reported so slowly that the numbers are outdated by the time they are publicized, for example in Google’s Sidebars covering specific colleges.

The Average Net Cost metric developed by CTAS is a superior metric, covering all students in an entering class, clearly acknowledging widespread income-based price discrimination by the industry, and including proprietary adjustments introduced to conform the calculations and avoid some of the reporting discrepancies found in the self-reported net cost numbers.

3rd-party outside monitoring: Business financial reporting is monitored by a combination of outside auditors, the government and investors. The situation with colleges institutional numbers is a bit different, but outside monitoring is nonetheless needed because the task is too complex to be left to consumers. The fact that the 2017 Net Price numbers from Howard came through and are still recorded after a year, in the 2018 provisional reporting, means no one at the Department of Education is looking at them (that is meant literally) because just a cursory check would provoke a request for a revision. The issues are complex and the regulators are not interested in walking the beat.

21st-century speed: In the age of Amazon and other live electronic marketplaces, the delay in Net Price quotes is a significant higher ed industry shortcoming. The government does not have the know-how to set this up and the colleges themselves seem to have no appetite to do so, so a third-party effort will need to be made.

The solution: up-to-date, verified, inclusive numbers.