Pennsylvania's Public Colleges I - Haves and have nots

Higher ed's themes replayed in a state with stagnating demographics

California has traditionally been seen as the precursor of America’s future but, for higher ed, evolutions in the demographically flat Northeast look to be the next wave.

Summary

Pennsylvania is a representative northeast state in many ways

Pennsylvania’s pool of prospective students is static (not declining)

The big schools have thrived…

While commodified regionals and community colleges struggle

Demographic stasis

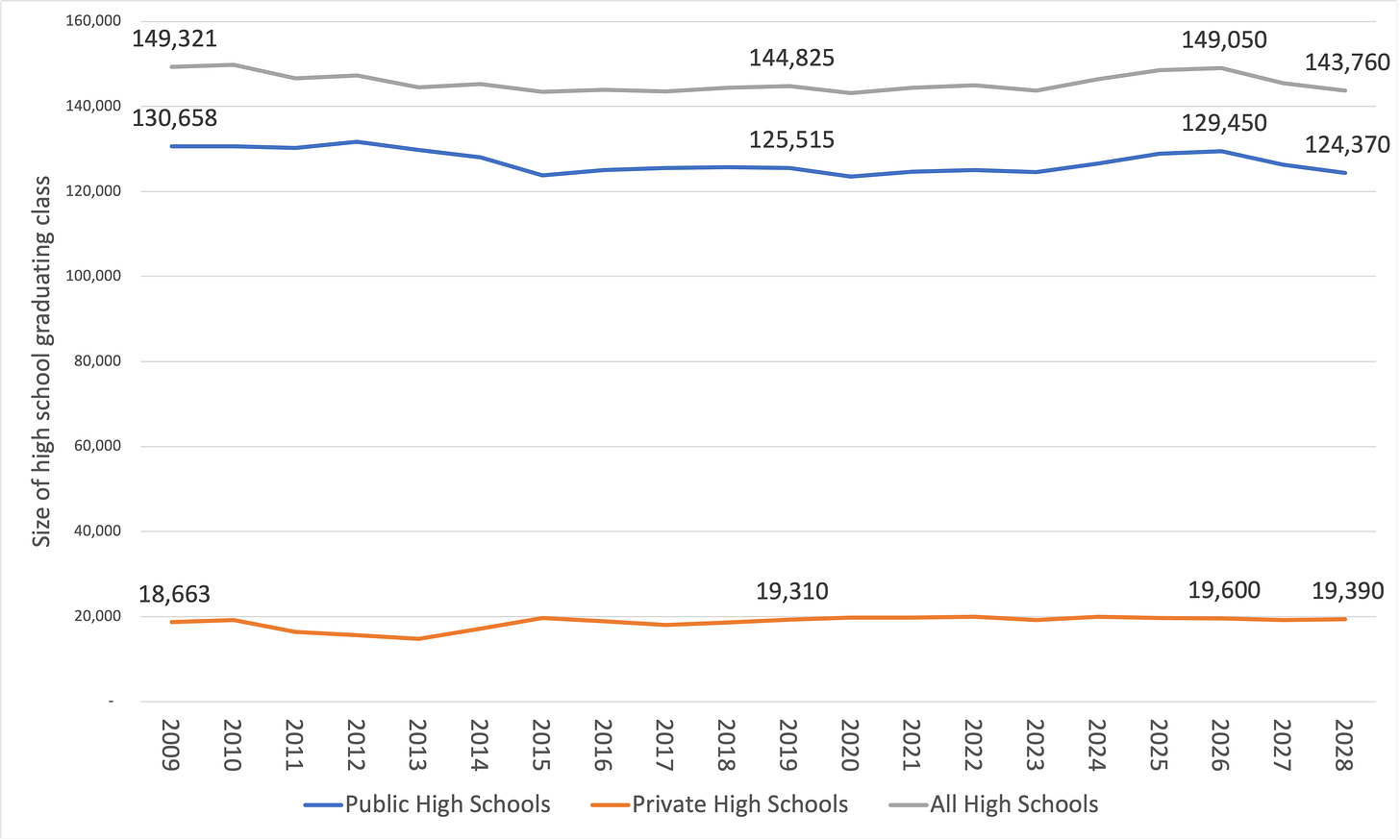

Like many northeastern states, Pennsylvania faces flat prime college age demographics, with the number of high school graduates projected to range between 143,000 and 150,000 over twenty years between 2009 and 2028.

Data, including projections, are pulled from the latest WICHE report on college demographics (Western Interstate Commission on Higher Education, Knocking on College’s Door).

Pennsylvania schools should benefit from a jump in graduates between 2022 and 2025, but current projections show modest declines thereafter stretching into the 2030s. There is no crisis here but it is not a growth environment.

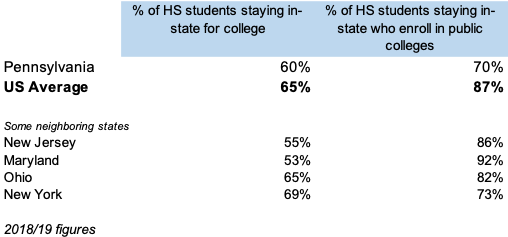

Pennsylvania public colleges are mediocre in attracting students

Pennsylvania is reasonably good at persuading its high schoolers to attend college in-state (a 60% rate in 2018 vs a US average of 65%) but these high school graduates attend private schools in greater proportion than elsewhere.

The end result is that Pennsylvania high school graduates are much less likely to attend their state’s public schools than elsewhere. This has of course added to enrollment pressures.

The Big get Bigger…

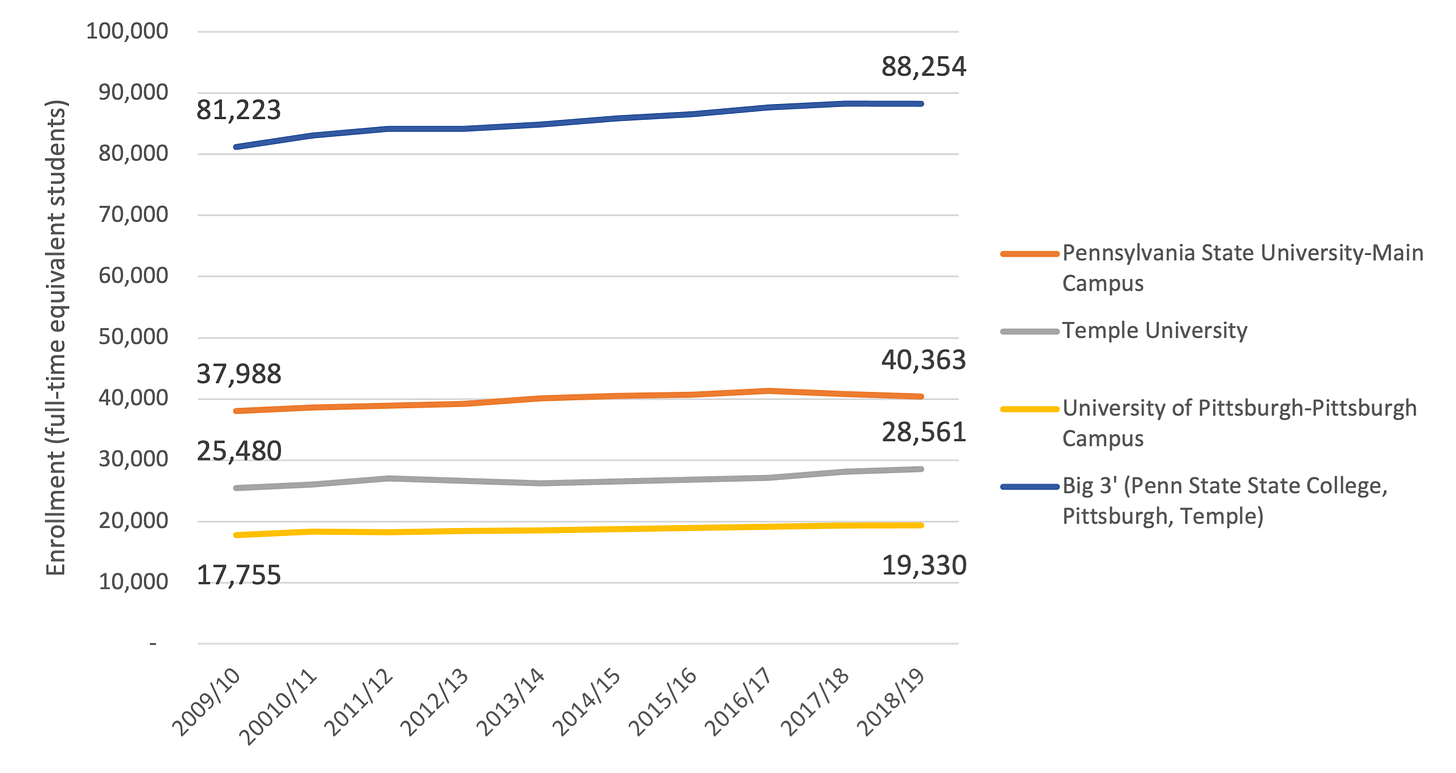

Pennsylvania publics encapsulate the national trend towards student preference for large campuses. The three big state schools - Penn State’s Main Campus, Temple and Pittsburgh - have seen both enrollment gains and favorable pricing trends. They thrived with a combined 9% increase in undergrad enrollment between 2009 and 2019 (full-time equivalent basis), with Temple performing the best at +12% and Penn State trailing a bit with +6% but still doing ok. This is within a national context where full-time undergrad enrollment fell 1% (FTE basis ‘09-’19).

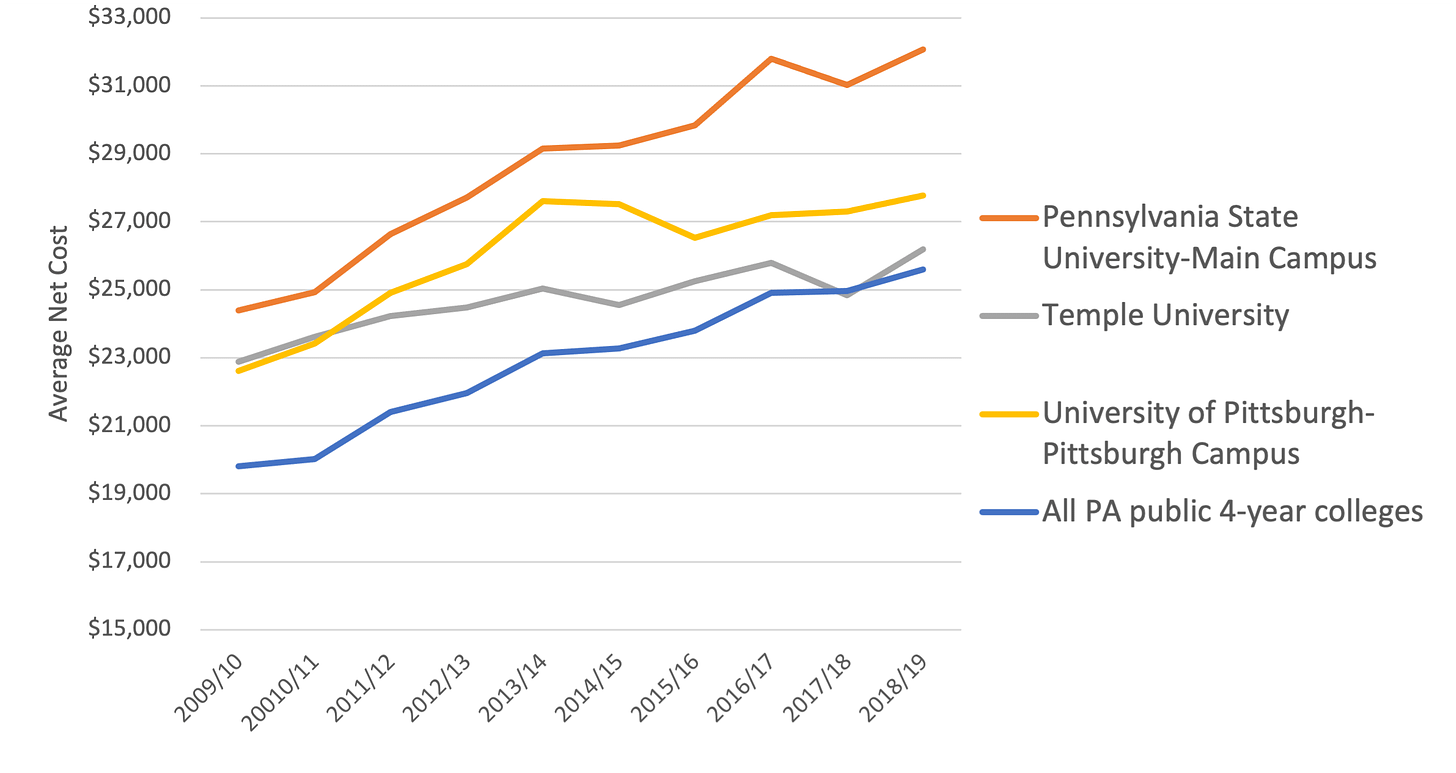

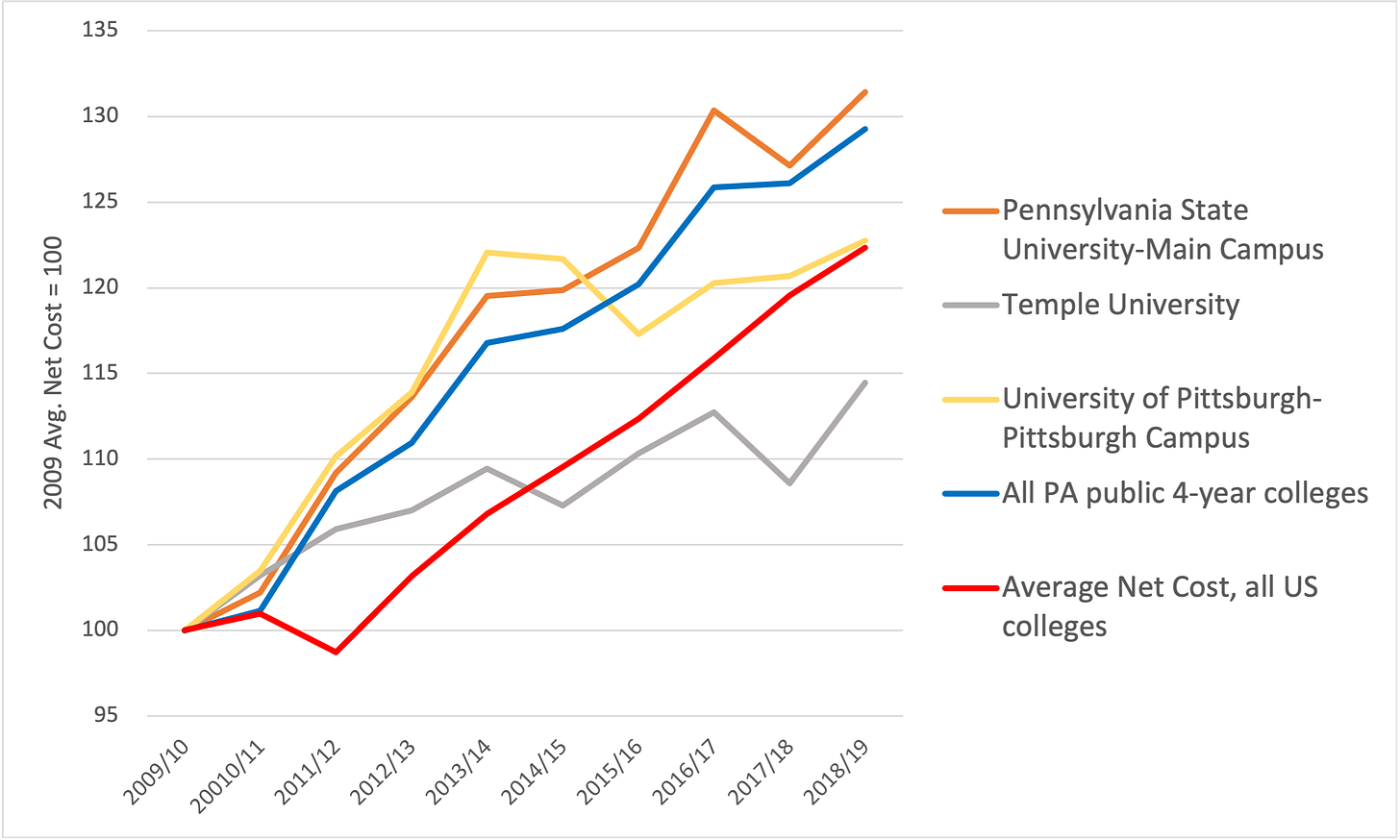

This gave the big 3 schools the pricing power to pass on some price increases as measured by Average Net Cost in excess of the public 4-year system, shown bellowing blue, where the other major constituent was the Pennsylvania State System of Higher Education (PASSHE) system.

The different price behavior of the Big 3 can be seen in the chart below, where Average Net Cost for 2009 is indexed at 100.

The undergraduate market has become very price sensitive and the competition among these ‘Big 3’ PA schools shows this in a nutshell. Temple raised prices a very modest 14% between 2009 and 2019 and benefitted from the highest enrollment increases among these schools. The Penn State Main Campus raised its prices by 31% in comparison, which is higher than the US average for 4-year schools over that time, and saw more limited enrollment gains. Pittsburgh’s pricing changes were very close to the national average with enrollment gains in between Temple and Penn State. The public 4-year system as a whole aggressively raised prices. Using the correct metrics - Average Net Cost - and keeping in mind a flat market size due to in-state high school graduating classes, one could have predicted problems for PASSHE, which is what in fact occurred.