Retention: California’s UC and CSU systems

Continuing the periodic look at retention stats across the country

How do we know whether a college is running an effective undergraduate program? Retention – the % of first year students returning for a second – offers an up-to-date measurement, and one which is frequently found very connected to student demand and interest. While it isn’t the be-all-and-end-all - other measures and information are important in “grading a program” - retention represents a bottom-line result measuring whether students can do the course work, can afford to pay for the program and, finally, like what they are getting from the college. Because retention at different classes of institutions isn’t comparable, this series tries to decompose what retention is telling us about schools in a given category and region to allow for valid comparisons so we can draw some lessons.

Following our first installment covering programs in Oregon and Washington, we turn next to the big public systems in California. The statistics for the two regions almost seem like they come from different countries. In 2019, the Pacific Northwest had two schools with admissions rates under 50% (UW, Reed). Most of the UC system lies under that threshold along with several Cal State schools, led by San Luis Obispo. The overall admissions rate average is a tad deceptive because admittance into several of the UC system campuses is quite a bit more difficult for state residents than for out-of-state students. California high schoolers face an unusually pressurized environment if they want to stay in their home state. So those in-staters attending these schools have successfully passed through admissions processes that are more selective than the overall averages indicate, something which partly explains the strong overall retention results.

Dog bites man

We’ll start by showing retention for the UC campuses tracked across admit rates. Warning: this may turn out to be the most boring, least informative chart in our whole series.

Readers of the e-mail can click on charts to see them magnified.

There is little to say about this except that the UC programs show similar — and consistently excellent — results. UC Riverside – the “laggard” – has retention of 89%, a very good result for a big public university. UC Merced, the system’s newest campus, specifically focusses on first-gen lower-income students and enrolls a disproportionate share of Pell recipients (over 60%). With that context, its retention of 82% is pretty high.

The CSU System

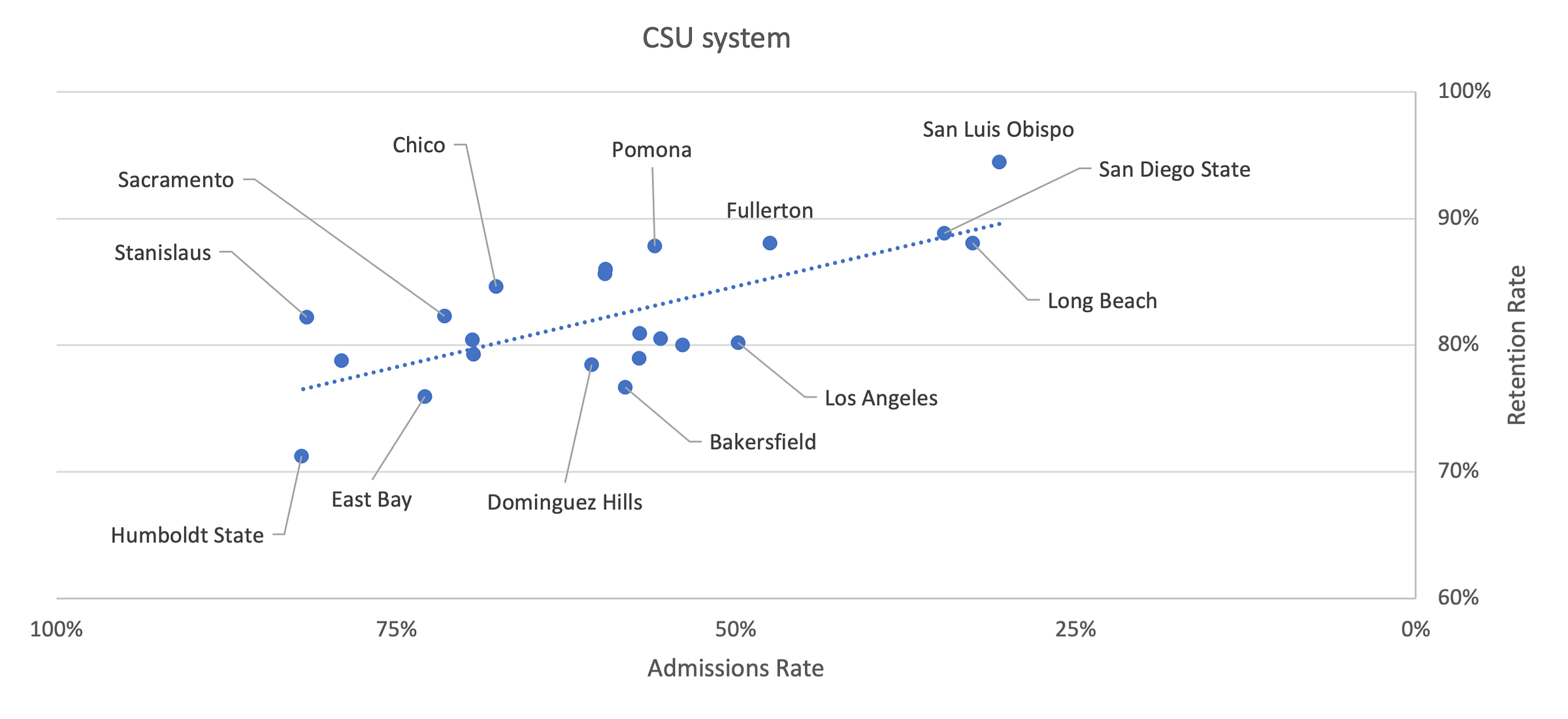

The Cal State system results are more variable:

Three of the CSU campuses are very selective with high levels of retention: Cal Poly San Luis Obispo, San Diego State and Long Beach State. While these schools traditionally live in the shadow of the UCs, they are more selective than most of the UC campuses and are close – though not quite equal – to them in retention.

The CSU system shows more divergent program performance than the UCs. Cal Poly Pomona accepts just about the same number of applicants as its Bakersfield sibling but has a retention rate more than 10% higher, a strong result.

Besides Bakersfield, the other underperformer is Humboldt State, located on the northern shoreline. Humboldt this January re-branded itself as the third polytechnic university in the CSU system, joining San Luis Obispo and Pomona, with additional state funding allocated, intended to address program shortcomings.

Thoughts

Forget education for a minute and consider in the abstract a highly competitive market where consumers receive significant amounts of professional advice. This market one would predict would have few opportunities for “deals” - unusually good results would be “arbitraged out”. The California college market is like this: students, often from prosperous families, applying to many colleges advised by a large number of consultants. And the outcome is, at least for the public universities, that there aren’t any major anomalies.

In the last installment on the Pacific Northwest, we’d pointed to Gonzaga University as a school which accepted 60-70% of applicants in years past yet boasted a retention rate just shy of the Ivy League. There aren’t opportunities like this in California’s picked-over market. Sure, Cal Poly Pomona looks like it deserves a bit more student interest but it, and a few other schools, aren’t outliers so much as above average performers. And Pomona, sure enough, saw a record number of applications in the most recent 2022 cycle in what was a far larger increase in student interest than other UC campuses. Students are already realizing the university’s advantages and exploiting that edge.

There aren’t many overlooked opportunities or hidden gems in the UC and CSU schools. The better the program performance, the more students want to attend.

The one untapped opportunity that jumps out is for out-of-state students at Cal Poly San Luis Obispo. If they can get in - which isn’t easy - they will study in a superior program, in a beautiful part of the country. And the cost proposition is excellent - San Luis Obispo discounts only lightly but its low cost of attendance means that out-of-staters typically pay net in the $44-47k range, much cheaper than the nonresident cost range at the UC campuses.

In an upcoming installment, we will look at the state’s private colleges to see if this highly competitive situation extends past the public systems.

Find more information at the CTAS site. CTAS provides data, reports and personalized assistance with college pricing and aid appeals.

Thanks for another insightful article!