Strada’s huge 2019 survey and college ROI

How much economic value do students see in a Bachelor’s?

College “Return on investment” (ROI) is a vexed question. Vexed because college is partly consumption – people attend to enjoy themselves – partly about learning for non-career reasons, and only partly serving as a launchpad for a career. We looked at this question from various vantage points, and think that minding some rules of thumb can help avoid outrageous investment decisions (e.g. borrowing $100k in student loans to start a career in a low-paying profession). One rule of thumb, based on US Census data, is that the typical college grad makes about $20k more than a high school grad, but with significant variation in results for both groups. How do the graduates themselves perceive the returns from college?

The Strada Network’s big 2019 report on college consumers provides an interesting insight. The report is based on a truly massive one-time survey of 340,000 (!) college graduates and drop-outs, covering their level of satisfaction and their perception of the professional value of their college enrollment.

A few takeaways before we get to the chart on career support and income:

Bachelor’s degrees were considered the worst of the four degree types for their cost-to-benefit.

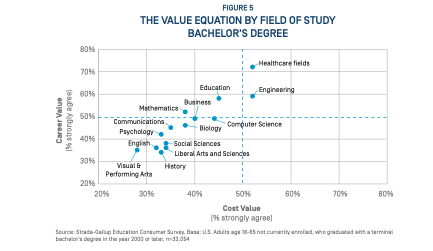

Majors in the humanities and social sciences were rated the least beneficial for both value-to-cost and pure career value. Healthcare was the best on both counts.

Vocational tech programs were considered both a better value than Bachelor’s and, surprisingly, just plain better for your career. We have been making the case that there is an oversupply of college grads and that fewer people should attend undergrad. Strada provides evidence for that view.

The Strada survey, done together with Gallup, covers: “cost value (whether consumers believed their education was worth the cost) and career value (whether consumers believed their education made them an attractive job candidate).” Strada disentangles the effect of graduate degrees, which usually required a Bachelor’s, from those of a Bachelor’s by itself. For example, figures 1 and 3 above include only those who completed a “terminal” Bachelor’s in the Bachelor’s bucket.

Income and the Value Equation

The graph reproduced above, which covers only Bachelor’s degreeholders and not drop-outs, is fascinating. The Strada authors, presumably Carol D’Amico and Dave Clayton, draw on it to write the following:

“Income is also a predictor of career value—to a point—with higher income associated with higher ratings. However, it appears that this correlation [between income and the perceived professional value of the college degree] only applies up to about $60,000 in annual personal income. After this point, income appears to have diminishing marginal returns. This is further evidence that while income is an important part of measuring the value of postsecondary education, it is not the whole story.”

While this is certainly valid, the graph points to something else. As they earn more, college grads assess their college degree as increasingly helpful professionally. Graduates earning below the median high school grad earnings are least enthusiastic about the career value of the Bachelor’s (career value: whether their education made them an attractive job candidate). A college grad earning $40k a year places more value on their degree than one earning $30k, and this perception of value rises until we reach the group making about $60k a year. Then it hits a ceiling.

That bound gives a different slant on the value of a college degree: 1/3 of graduates will work a job that doesn’t require the degree. 2/3 of graduates will work one that does but the Bachelor’s itself helps get you to about $60k in annual income. Earning more will require more: hard work, discipline, native intelligence, hard & soft job skills and luck. So a Bachelor’s is the foundation of a career, but investing in it holds risks and there is an upper limit to its value. That isn’t an argument against going to college but it’s an argument for keeping its economic upside firmly in sight when thinking about how much it will cost.

The US Census puts the median income differential between high school ($36k in 2019) and college ($59k) at a bit above $20k. The college grads themselves see the earnings benefit maxing out at about $60k, about $25k above the median high school annual earnings. Two entirely different methods - Strada’s survey and US Census data on the labor market - get to a similar place. Looks like the “R” in Return on Investment is right around $20-25k annually for the typical college grad.

Strada on Supply & Demand

A recent post had argued that higher ed government policy must heed supply and demand signals from the labor marketplace and that the drive to increase college attendance was misguided. Strada, using their rich survey results, makes a supporting point:

“Local attainment levels also predict career value for bachelor’s degree holders. We find evidence that the law of supply and demand applies to bachelor’s degrees: scarcity creates value. Bachelor’s degree holders living in cities where a lower percentage of the population holds that degree are more likely to strongly agree that their education makes them an attractive job candidate. Conversely, cities with a higher percentage of bachelor’s degree holders see lower ratings of career value for that degree.”

This regional analysis supports the view that Bachelor’s degrees are subject to the same supply & demand dynamic as other credentials and suggests that overlarge cohorts of college grads lowers the professional benefits of college.

For more posts and information, visit the CTAS business site.