The Great Recession and Undergrad Enrollment

A lousy job market encouraged young and old to go to college

To get a better handle on the COVID Recession’s impact on future college enrollments, the Great Recession in 2007-2011 can help us trace patterns of behavior. The two recessions are very different in origins and profile, but the ultimate result — job losses, lower incomes and changed life paths - are at bottom the same. The COVID Pandemic, distinct from the Recession it has caused, will also have a strong influence on enrollment patterns, of course, so this like most historical studies, is in no way a controlled comparison. But because the final impact on people is similar, the patterns from the Great Recession will be suggestive of what is to come.

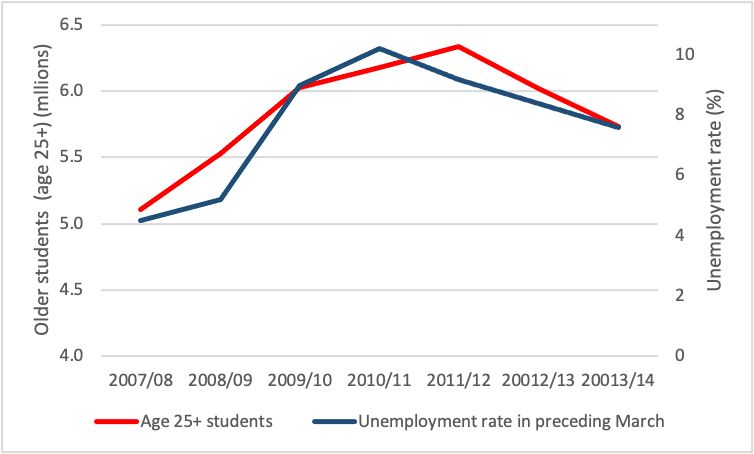

Unemployment and enrollment are correlated, as is well known. College enrollment takes some planning, so the unemployment situation a few months before a student actually begins classes is most relevant. If we look at the unemployment rate about 6 months preceding this enrollment in late August to early October, we see relationship between the two trends for 2007-2014.

The interest of older students (age 25+) in pursuing a degree is particularly sensitive to labor conditions.

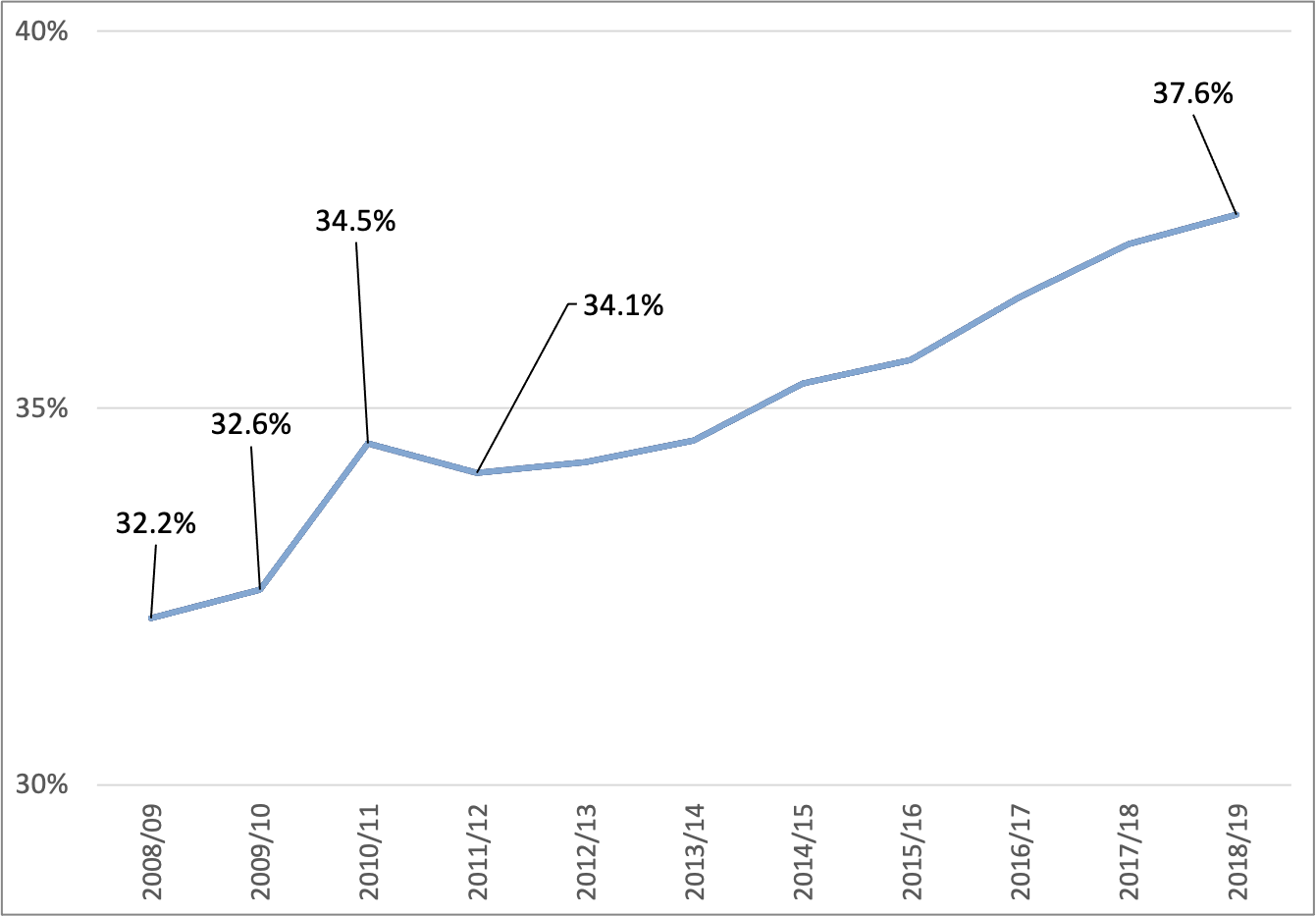

All student enrollment is affected by the economy. Enrollment of prime age students (< age 25) increased by 13% (1.4 million students from trough to peak); that of older students (age 25+) by 21% (1.2 million, again trough to peak). The Great Recession bump played out against the long-term trend of prime age students becoming gradually more likely to attend colleges, a secular trend predating and outlasting the Great Recession. The Great Recession’s +1.4 million increase in prime age students is partly the result of this long-term trend and also partly cyclically driven by the economy. The chart below shows the trend during and after the recession.

The bump upwards in 2010 indicates that economic conditions also propelled prime age people to enroll in college above historical trends. Our estimate is that roughly 500,000 prime age students enrolled in 2010-11 due to economic conditions (more about the changes to the coincident increase in Pell Grant funding below).

Estimate details: The chart below measures the % of the age 18-25 cohort in the US who are enrolled in an undergraduate program, what we dub the participation rate. The trend growth in this period was a ~0.4% participation increase year over year. Absent unusual events, one would expect the participation rate in 2010 to be ~33.0% and 2011 to be ~33.4%. The 500,000 estimate above is based on this simple math: the difference between the expected participation of 33.0% based on trends lines and the actual participation rate of 34.5% multiplied by the cohort size in these years (34.7 million) equals ~0.5 million.

Summary: Both older and prime age students enroll in college due to bad economic and labor market conditions, but older students are more sensitive to it. The Great Recession is estimated to have increased undergraduate enrollment by a total of approximately 1.7 million (prime age: 0.5 million, older: 1.2 million). Given a total undergraduate enrollment of 16.7 million in 2008 across US higher ed, this represents an increase of 10%.

2008’s college enrollment surge anticipated labor market metrics

Data shows that enrollment by older students increased before the unemployment levels truly began to rise. Without very specific data on this phenomenon being accessible, some broader numbers allow us to at least construct a mental model of why this might happen.

Firstly, the number of unemployed out of work for long periods of time increases slowly as a recession gains steam. That this pool of unemployed workers is important to potential college enrollment is intuitive: being out of work for a few weeks would not radically alter a person’s life plans, but an extended period of unemployment combined with difficulties finding a job would lead many to make the rational decision to upgrade their knowledge and credentials.

The 2008/09 academic year saw an 8% increase in college enrollment in the age 25+ group, despite the unemployment rate in the months preceding that autumn hovering in the region of 5%, a low rate that would usually denote job market strength. (The March 2008 rate was 5.2% and the April rate was 4.8%. Over that summer, the rate began to increase and by September 2008, when Lehman failed, the rate was 6.0%.) In absolute numbers, the number of long-term unemployed workers stayed roughly constant at 1.3 million during 2007 and 2008. But these stable numbers concealed a worsening economic situation.

Because the unemployment rate is a lagging indicator of job market weakness, the impact is felt by people before the headline number increases. Long-term unemployed find it harder and harder to land a job. Other workers take unsatisfactory positions which they want to leave, while workers with jobs become more fearful of losing theirs and start considering college. All of those conditions intensify the interest in pursuing a degree within a certain subset of workers. And this would occur despite the fact that metrics like the unemployment rate and numbers of long-term unemployed look placid on the surface. College enrollment here anticipated further economic weakening, even if the actual higher ed data took several years to report and finalize.

The Great Recession’s lousy labor market released latent demand for higher ed

Another interesting detail about the Great Recession is how enrollment among older workers was a much larger share of the long-term unemployed at the beginning of the Great Recession than in later years, as the slowdown dragged on. The chart below illustrates this fact. Setting both the number of long-term unemployed and the older undergrads level in 2007 to 100, we see that new students match rising long-term unemployed at the beginning of the recession, in 2007 and 2008, but does not increase proportionally with the number of long-term unemployed as it drags on.

What does this mean?

One possibility is that the length of unemployment was increasing before the absolute numbers of long-term unemployed increased — but this is not the case. The average length of unemployment hovered around 17 weeks until August 2008, right before the Lehman failure.

Because enrolling in college takes at least a few months of planning, we can conclude that an outsize number of older students had decided to start or resume their studies in what was, at least on the surface, a solid job market. The 2008 enrollment showed an increase of 0.4 million older students (rising 8% from 5.1 million to 5.5 million) using the Fall data collection round by the Dept of Education.

Let’s venture a hypothesis as to what happened here: there exists a pool, a subset of older workers who have been meaning to either enter or resume their college studies, but put it off because their work lives were satisfactory. A weakening labor market not only means it is harder for the unemployed to find work, but also that the employed suffer. It gets harder to be promoted and to find a better job, and meanwhile the workload increases as companies don’t hire to fill positions. All of these factors would increase the attractiveness of pursuing college.

This is a hypothesis, not a conclusion. Data to confirm or disconfirm the idea will be very difficult to assemble, unfortunately. And to complicate things, the unemployment crash of 2020 was so rapid and unexpected that the pool of prospective college students wouldn’t have had time to weigh their options. They were either immediately out of work or still on the job.

Another consequence of this early wave of recession-driven unemployment is that the larger numbers of people who become unemployed later in a recession are much less interested in attending college.

This is not meant to imply that all of the increased older student enrollment comes from the pool of the long-term unemployed. It instead suggests that a sizable number of unemployed workers are simply not interested in college and that the early job market weakening early in a downturn often encourages many of the people already considering college - the real pool of prospective customers - to enroll.

Pell Grant Expansion

The Pell Grant program was increased and converted into an entitlement by legislation enacted between 2007, before the recession began, and 2010. Program spend rose from $13 billion in 2006/07 to $30 billion in 2009/10, hitting its historical high $36 billion in 2010/2011.

The earlier graph on prime age group (18-25) shows an out-of-trend jump in college participation in 2010/11, after the steepest Pell spending rise. As mentioned, short-term fluctuations take place within a long-term secular increase in college participation by this prime age group, so assigning any direct impact to the Pell increases rather than the Great Recession is difficult and needs to be heavily qualified.

The enlargement of the Pell program seems to be less directly related to decision-making by older students who, unlike recent high school graduates, are not on a well-trodden path to college. Most of the increases in older students enrollments took place in 2007-2009, with the peak of 6.3 million reached in 2011 (vs 5.1 million in 2007) just when the job market was finally showing a positive trend for the first time since the recession’s arrival.

Disentangling the influence of the job market and the Pell expansion is difficult in practice but it may not even be possible conceptually. Surely, many individuals would have been influenced by both when deciding to enroll. Once enrolled, are students who persevere and gain a degree helped more by incremental Pell funds than motivated by a poor economy? Others have wisely abstained from distinguishing the causation. We won’t speculate or guess at numbers.

The Great Recession and the COVID Recession

What do these patterns mean for 2021 and beyond? Extrapolation from history is always tricky, of course. The Great and COVID Recessions have different causes, different impacts and different timelines. The speed and unexpectedness of the COVID Recession led to 30 million workers losing their jobs within the space of two months. The Great Recession unfolded over several years and precipitated a financial crisis. We assert that the patterns from the Great Recession will be similar (history rhymes, it doesn’t repeat) to COVID but at a lag, with the process beginning in earnest in 2021/22.

Timing: Enrollment declines in 2020/21 do not show that the Great Recession’s patterns are irrelevant. We have all just survived the COVID onset in spring 2020 and can attest to that strange combination of dread and listlessness that pervaded American life at the time. This was (hopefully) a unique social moment and it severely affected life planning in a season when high school seniors finalize their college plans and many older students decide whether to pursue more education. Whatever the nuances of this moment, we can all agree that it was not conducive to long-term life planning and the energy associated with starting college. So the ethos of the moment set it apart from any normal time and exempted the Fall 2020 enrollment results from normal patterns.

Cratered industries and their collateral: The Great Recession saw the housing sector and financial services initially impacted, with collateral damage to other industries spreading out. Due to COVID, restaurants, travel and retail have been devastated, especially in cities, with collateral damage spreading outwards. Forget the details; underlying economic patterns are key. Millions of works and small business owners are unable to spend much money now and this will affect almost all industries, and take time to show up, especially because the large but temporary fiscal measures taken by the Federal government in 2020 muted the immediate impact.

Colleges flex pricing: After years of surging beyond inflation, the average net cost of attending college fell from 2008 to 2012 due to declining median family incomes during the recession. We predict the same thing will happen in the next few years, private colleges with higher admission percentages leading the way. (Private colleges cut their average net cost by 6.1% in 2009 alone and by a total of almost 11% between 2009 and 2011.) College price cutting will also attract more students, though, which will support an enrollment bump similar to the Great Recession’s.

White-collar’s future: One risk that could turn out to be significant is a less attractive and more informal future for white collar work. Colleges train workers for white-collar jobs. COVID has reoriented work practices in an economy where the white-collar employment marketplace was already not good. (This isn’t implying that blue-collar or service work environments were good. They were even worse than white-collar’s.) Such a re-orientation could have a sizable impact on the nature of credentialing and prospects for conventional jobs. Though not a direct impact of the COVID Recession, such a change would be part of a longer-term evolution where the pandemic served as an accelerator destabilizing white collar work and, along with it, higher ed.