Vandy pushes the envelope

Vanderbilt raises its list price to just shy of six figures

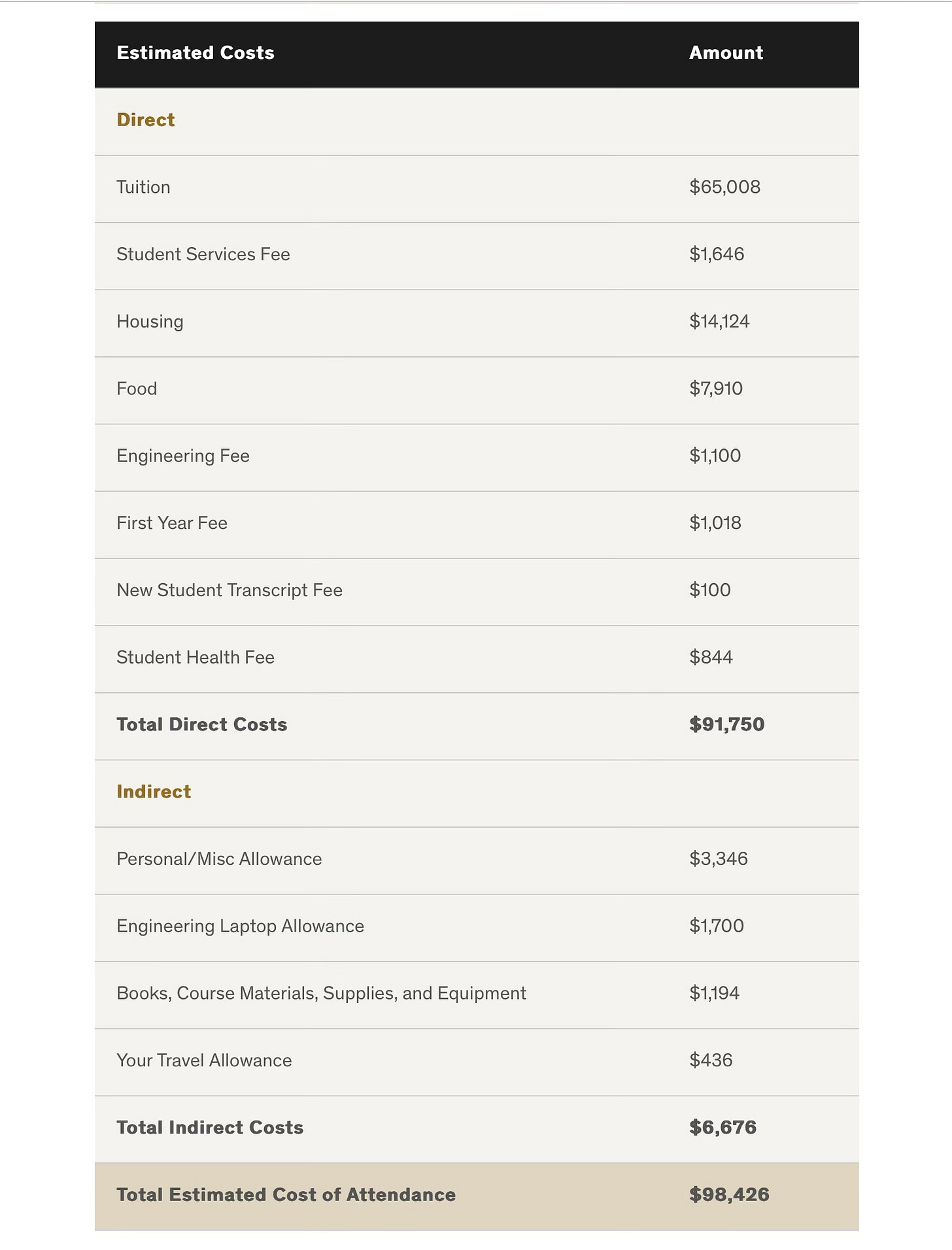

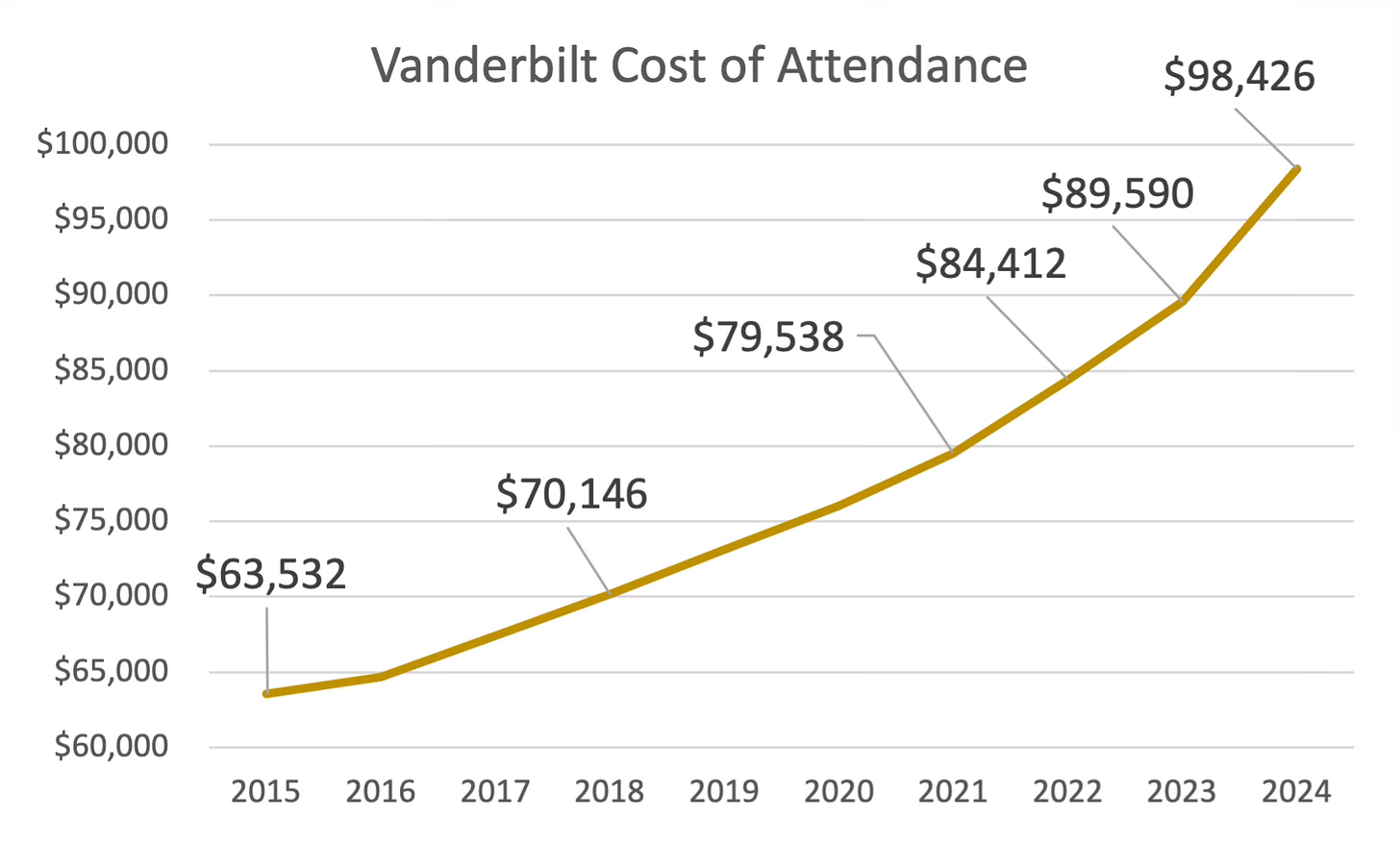

There has been speculation that the University of Chicago would be the first US institution to feature a 6-figure list Cost of Attendance. That 6-figure threshold is at hand, but the college on the verge of bridging the Rubicon is not the U of C, but Vanderbilt University in Nashville. Vanderbilt recently distributed award summaries that showed a cost of attendance of $98,426.

Though universities occasionally reduce their cost of attendance between the distribution of awards to entering students and the final price setting in the middle of the calendar year (the University of Iowa appears to have done this in 2023/24), we would typically expect a bit of creep upwards from the initial announcements. (Why are colleges even allowed to do this? We will leave that for another day.) As a result, we can be reasonably confident that, in 2025/26, Vanderbilt will break that 6-figure barrier, with a cost of attendance likely in the $100-103k region.

This 2024/25 cost of attendance represents a 9.9% increase from 2023/24! Vanderbilt has been aggressively raising its prices for several years now, but this latest % increase outdoes historical patterns:

As we know from seeing prices marked at say $4.99 or $9.99 when we shop, there is a widely recognized psychological effect (labelled the “left digit” effect, which relies on consumers looking only at the first digit on the left and no farther) of holding stated prices just shy of changing that first digit. Meaning that crossing that numerical barrier, whether it be $5 or $100,000, is a jump that will leave certain potential consumers behind. Will that marketing truism be recognized by colleges, as they hold off on raising their list price past $99,000? Some certainly will but we expect six figures to be the norm for highly selective private colleges in the next 2-3 years.

To anticipate a possible rebuttal from Vanderbilt, it is true that the school gives out more institutional aid than Ivy League schools. In 2021, only 38% of Vanderbilt first years did not receive any institutional aid, an omission suggesting a family income above $350k annually. This is lower than the Ivy League schools, where a rule of thumb that roughly 55-60% of students receive no aid and have those kinds of financial resources is usually valid. The fact that Vanderbilt does give out more aid than certain private competitors may have emboldened them to raise their list cost of attendance far beyond levels of peers like the University of Miami (recently set at $93,666 for 2024/25). We will need to wait to see whether the 6-figure price tag intensifies the reluctance of many middle and upper middle class families to consider selective private colleges, where the evidence will accumulate over a number of years. But there is data showing this cumulative impact is underway, as families increasingly send high-performing students to big flagship state universities, with their more contained prices.

Substack DMs are open or leave a note below if you are seeing list prices above $90k (cost of attendance – make sure to include indirect costs!) from other universities, like NYU or Wake Forest.