Latest inflation statistics: tuition +1.3% 2021 v 2020

Low tuition growth v general economy-wide inflation of 6.8%

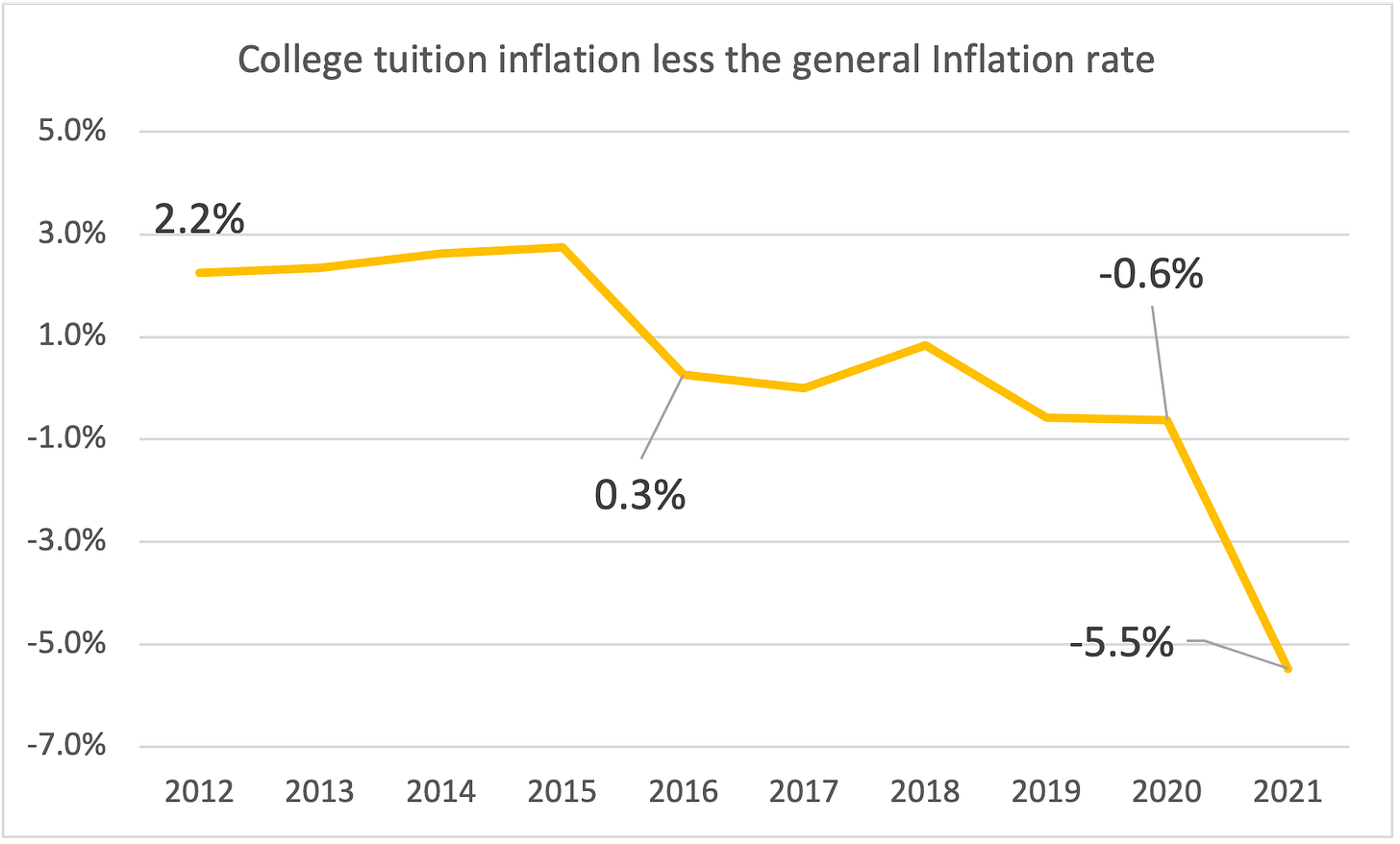

On Friday, the Bureau of Labor Statistics (BLS) released its latest data on consumer inflation, a report eagerly awaited by financial markets. The general inflation index for the US economy as a whole increased 6.8% and the metric covering college tuition and fees increased at an annual rate of 1.3% (not seasonally adjusted), a difference of 5.5%.

In our prior post on BLS inflation, raw metrics had pointed to a -0.1% rise July year to date in its college tuition index. BLS econometricians had applied a seasonal adjustment correction to that (college pricing unsurprisingly is subject to seasonal forces) to produce a +1.1% figure for July year to date, similar to the unadjusted annual rate the index is now showing. (Nice work, BLS!)

In the post covering the July results, we wrote that the figures for the upcoming months and the beginning of the new academic cycle would be very significant. We had held off reporting on them because the BLS normally corrects figures for the most recent months - corrections did in fact occur - and because we wanted all the data for the new Fall term to be tabulated by the agency. The BLS had initially shown a tuition increase slightly above 2% year-to-date. These numbers were just revised down with Friday’s report, a revision which came as a surprise, at least to us.

This divergence between college and general economy inflation is significant. Regular readers are familiar with CTAS’ pessimistic take on undergrad program pricing power and economics. The latest figures surprised on the downside. Let’s distinguish between impacts on the revenue and the expenses side:

Revenues: Even in an environment with rapidly rising prices, including housing, and a buoyant financial markets boosting the wealth of many families sending students to college, colleges were unable to raise prices much.

Expenses: Cost pressures will harm colleges’ financial health. With a 5.5% gap between the inflation colleges are generating in revenues and the general economy, colleges will see rising non-employee costs without offsetting tuition gains. How compensation of higher ed employees works out in this environment will depend on these cost pressures and the worker shortages all employers are seeing today.

Fitch Ratings drew a similar conclusion in their November outlook: “Median expense growth is expected to inch upward in fiscal 2022 as universities absorb inflationary increases in supplies and labor.” Fitch noted that the increase in maximum Pell Grants in the “Build Back Better” legislation, an act with a current size of $1.75 billion, would help offset some of the cost increases and provide a buffer.

This Fitch view is consistent with what we found in measuring the results from the last Pell Grant expansion, in the wake of the Great Recession, but note that the increases in the 2008-2011 period were far larger than in the Build Back Better package.

A more productive revenue enhancement tactic might be lobbying states to increase their aid to higher ed, especially to public institutions. Example: the Alabama Commission on Higher Educations formally requested an extra $2 billion in state subsidies for 2022-23, specifically citing rising employee costs. The linked article points to similar requests in Louisiana and Kentucky.

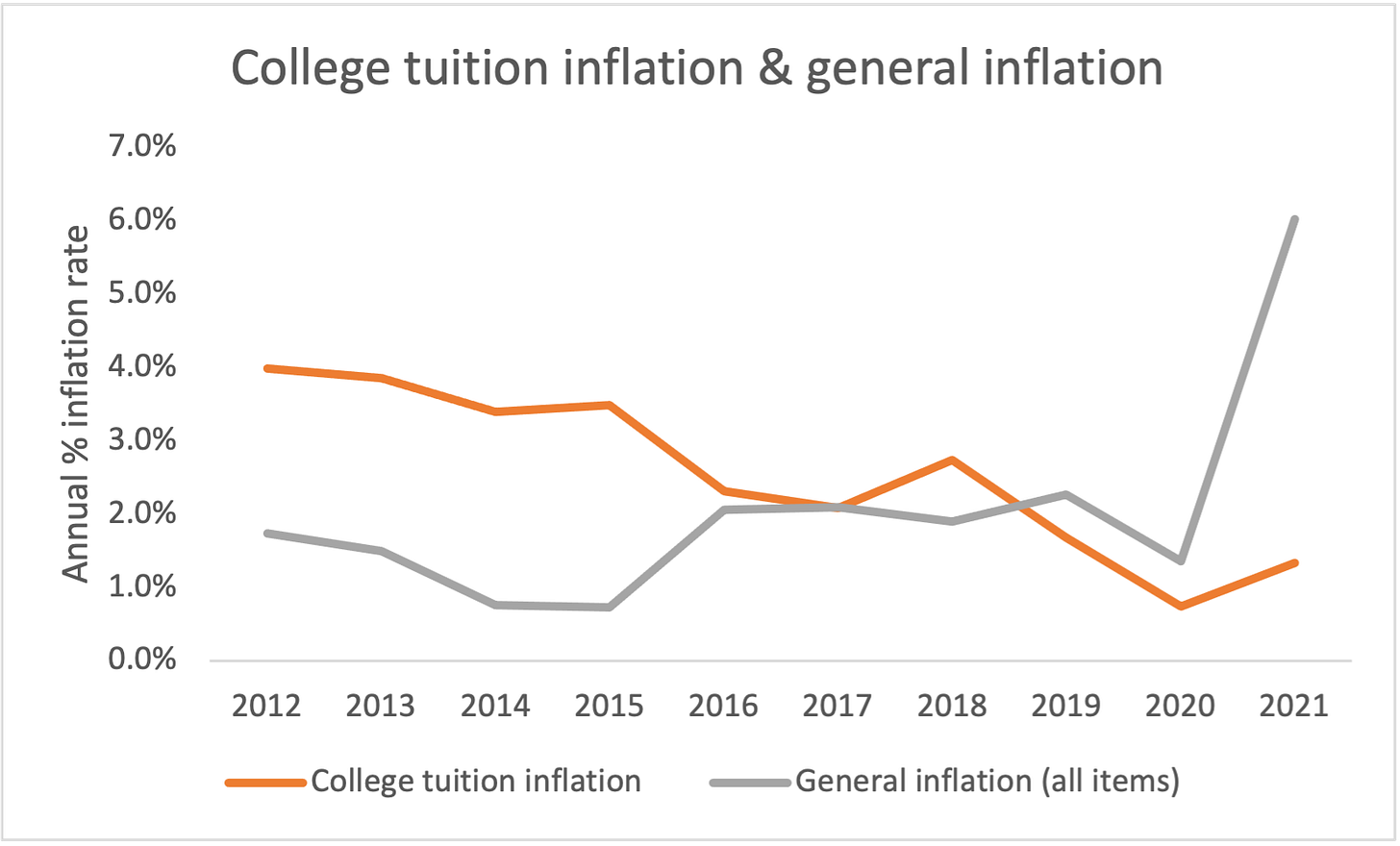

The historic time series for tuition inflation illustrates these trends. College pricing has gone from increasing more than general inflation (pre-Great Recession), to increasing at a bit under the rate of inflation (the 2010s). to falling behind the rate.

Subtracting general inflation from college tuition inflation shows the industry’s weakening pricing power:

This 2021 gap is unprecedented and may cause a sea-change in higher ed and how it operates if it becomes more than transitory (Official Economic Buzzword). Gaps like this are industry shaking if they persist. But there are good reasons for thinking this burst of inflation is temporary with certain investment banks predicting a return to normal inflation in 2023. We will be keeping an eye on these metrics with regular updates in the future.

CTAS numbers are “live”, with our modeled net cost forecasts adjusting to inputs as they change. In line with the new BLS numbers, we have revised our general college price inflation down to 1.3% for 2022/23 v 2021/22, which will flow into pricing inputs and reduce estimates of both 2022/23 academic year and full program costs going forward. While the forecasts normally rely on historical trends in family income, GDP and college costs, the economic situation during COVID is so unusual we are now opting to use BLS’ +1.3% increase to estimate 2022/23 pricing. Despite 2019’ surge in family incomes, then COVID, then the current inflation burst, college inflation before mix impacts has come in at around +1% give or take a margin. That appears to be the running rate today.

Read this post and others at the CTAS site.