Pennsylvania's Public Colleges Part II - the PASSHE situation

Part II of our series on Northeast higher ed trends

California has traditionally been seen as the precursor of America’s future but, for higher ed, evolutions in the demographically flat Northeast look to be the next wave.

In our first post on Pennsylvania’s public colleges, we noted that the state met with below-average success in attracting the state’s high school graduates, who stayed in-state at rates below the national average but then disproportionately attended private schools once they stayed. Despite this situation, the ‘Big 3’ public universities - Penn States, Pittsburgh and especially Temple - had managed to generated outsize enrollment increases. But alongside these successes, certain undergrad institutions suffered, such as the Pennsylvania State System of Higher Education (PASSHE) system. We saw that PASSHE schools as a group aggressively raised prices beyond national averages. Using the Net Cost metric and keeping in mind a flat in-state market, one could have predicted problems for PASSHE, which is what in fact occurred.

Trouble for the state’s regional network

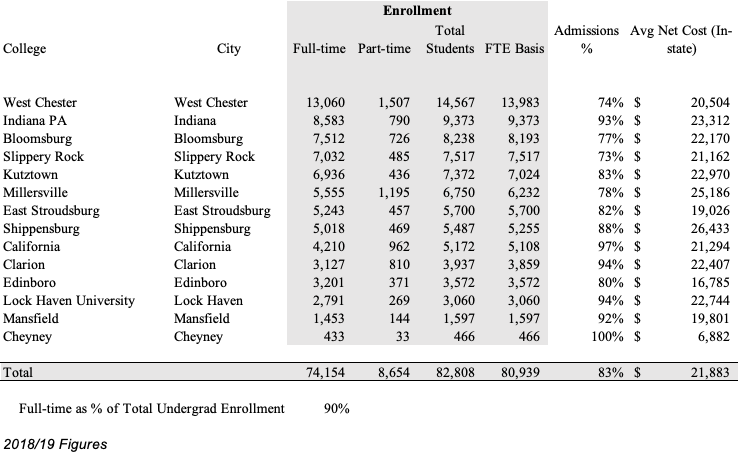

Pennsylvania has a fragmented public higher ed management structure (this is a description, not a criticism): the ‘Big 3’ schools run themselves independently and each in turn run satellite campuses, which are not included in the numbers presented earlier. PASSHE is managed separately from the ‘Big 3’ and uses a somewhat decentralized management structure. It is a network of 14 regional 4-year schools schools located generally in rural or suburban areas with a predominantly full-time student body.

The 14 schools are residential, with on-campus housing provided to students at rates similar (~40% of enrollment) to other state schools.

The fallout from a mediocre demographic position and the increasing advantages large US universities enjoy in attracting students led to revenue issues at PASSHE. Earlier in the 2010s, agitation had emerged from college leaders and state legislature supporting rule changes to allow network schools to secede from the system, with the system’s largest one, West Chester in suburban Philadelphia, being the most vocal. More recently, PASSHE has planned and initiated a restructuring which has received a fair amount of industry and local press attention. The restructuring data collection was kicked off in 2016, a plan was proposed in 2019 and its execution began in 2020.

The PASSHE system saw a 2010s troubled by enrollment declines and financial weakness. PASSHE enrollment fell from a peak of 99k students in 2011, the peak of overall enrollment in US higher ed, to 81k in 2018.

This enrollment decline was not prevented by loosening admissions. PASSHE began the decade as fairly selective and ended it as being close to open admissions.

The increase between 2012 and 2013 rates looks like a system-wide policy change but in fact the sharp increase occurred at certain campuses (California, Indiana, Bloomsburg and Kutztown) while others, including West Chester, saw their acceptance rates rise gradually over several years. Another way to think about the data is that, in 2010, all campuses accepted under 70% of applicants; by 2018 all campuses accepted at least 74%. West Chester was particularly affected: it went from being close to a highly selective school in 2010 to accepting that 74% ratio in 2018. Despite the loosening admissions standards, enrollment across the system fell.

The enrollment was not mirrored by any limits in cost increases as we see using CTAS’ comprehensive Average Net Cost metric.

Again, let’s present those increases in Average Net Cost by indexing all series at 100 for 2009 along with the broad US undergraduate average.

The 35% increase in pricing by PASSHE in the decade outpaced its local competition (Penn State, Temple and Pitt), the regional competition (mostly the ‘Big 3' branch campuses) and US national averages. The network’s enrollment declines have certainly been caused by a combination of marketing, demographics and increased consumer preferences for large schools, but the failure of PASSHE management to cut prices in the face of declining demand has to be a big contributing factor.

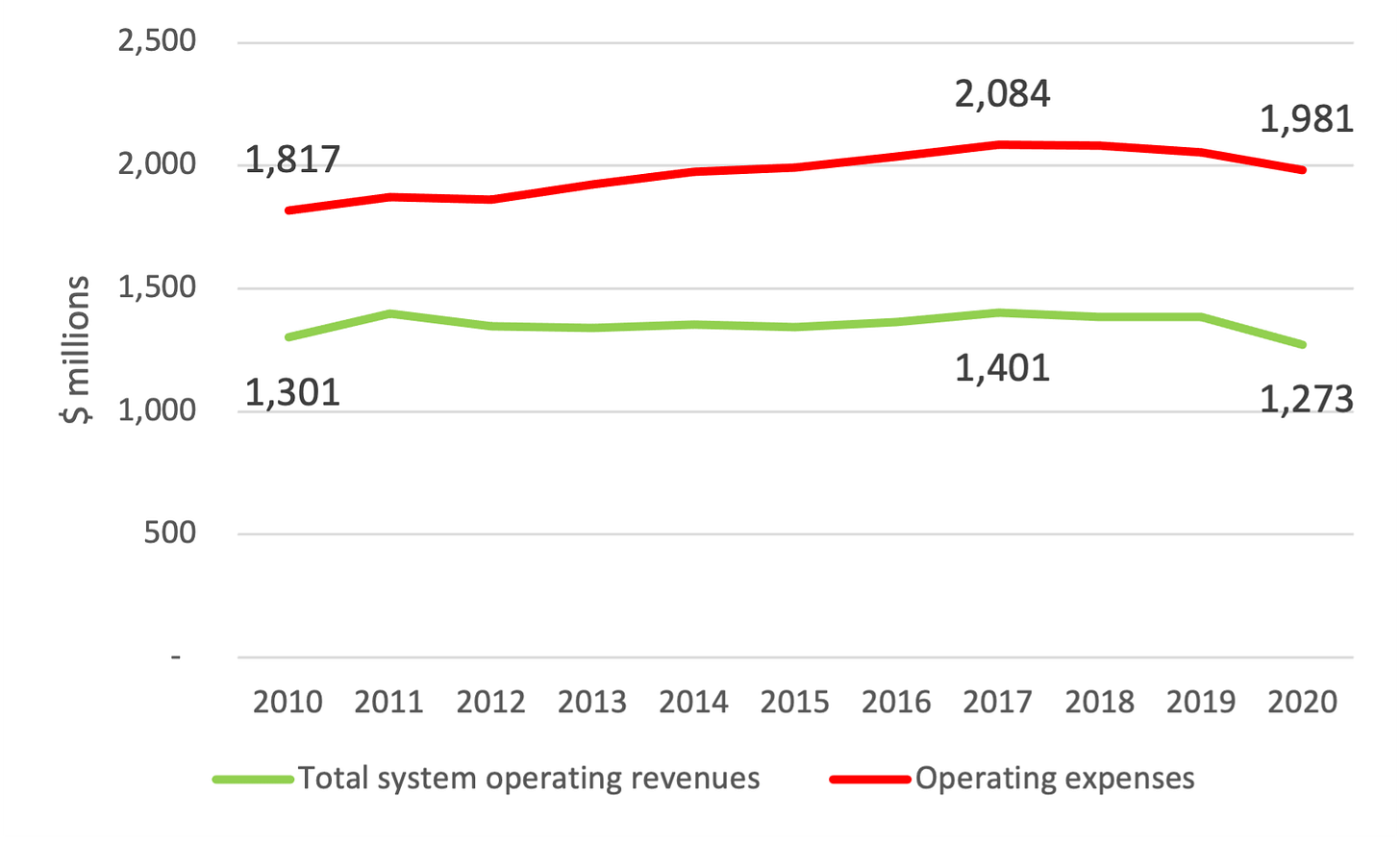

PASSHE spending and revenues

In this time of revenue constraints, the system had a difficult time containing its spending. Flat revenues were not matched by flat budgets.

Figures are from PASSHE system financials, including the most recent 2019/20 financial reports. Operating revenues exclude state aid. The enrollment and tuition data presented above stretches to 2019 and the financial reporting, which is delivered earlier, shows intensifying issues after this end point in 2020.

If PASSHE was raising prices beyond US averages, this was not meeting with either financial or enrollment success.

Declines in state aid were not at the root of the financial problems. In fact, the state had managed to increase system funding close to its level before the Great Recession cuts despite the fact that the higher aid covered fewer students.

Because the PASSHE income statement includes a complicated set of accruals related to public employee benefits, it’s helpful to look at the system’s Total Debt metric for a cashflow-based picture of the decade.

With all cash in- and outflows included, the system ran a deficit of approximately $250 million in the decade. This is a troubling though not disastrous evolution, but it could present problems given the pressures on the Pennsylvania state budget caused by COVID. A reduction in state aid to Great Recession levels would have caused this debt load to begin increasing sharply absent a restructuring. The PASSHE management and Council of Trustees should be commended for taking proactive steps in advance of a recession, but at the same time criticized for not stalling the price increases that are partly to blame for developing problems.

PASSHE Next Steps

The network’s next systems relate to financial stabilization.

Revenue rationalization: Tuition needs to be cut to levels that prevent further enrollment declines, so they must be benchmarked to regional systems in neighboring states and vs the Big 3.

The painful restructuring and cost cutting already initiated must be executed. The possibility of merging operations at six of the colleges is being advanced. Fortunately, several initiatives pursue growth.

Clarion and California are launching a purely online effort, with a marketing effort.

Lock Haven and Mansfield are joining together to revise their workforce credentials programs.

Lack of brand image and positioning needs to be addressed. Kutztown has initiated a rebranding, with an altered name, a relaunched advertising campaign and a redesigned website. Clarion’s online effort has marketing dollars deployed behind it. Despite the spend, PASSHE needs to address a low local profile and a lack of awareness about what it and its degrees represent. This may not be a solvable problem - much of undergrad is an undifferentiated commodity - in which case enrollment declines will need to be tackled by cutting prices.

Pennsylvania’s community colleges

While PASSHE has received a fair amount of state legislative and press attention, the community college network has suffered quietly. Enrollment was down 13% in the decade, the same % decrease as PASSHE.

Though Average Net Cost is a less useful metric for community colleges, with their large proportion of commuting and part-time students, than for residential colleges, we can use it here to assess how expensive Pennsylvania community colleges are compared to the national average.

As costs vary between states and regions and Pennsylvania’s housing costs would be slightly higher than the rest of the nation, the baseline growth in Average Net Cost provides another illustration of how the state’s system increased costs above the national average.

Pennsylvania community college enrollment decline, however, compares favorably to national trends, as US 2-year enrollment declined by 21% in the 2009 to 2019 period (FTE basis). Despite disappointing absolute numbers, Pennsylvania was able to limit the decline in 2-year program enrollment while increasing prices by a bit above the national average.

Undergrad program revenues

Another way to present the divergent stories of big public universities and their smaller regional and community college brethren is through estimates of tuition revenues. These are difficult to compare normally as system financial statements often combine non-tuition and non-undergraduate revenue streams in one line item. Accounting differences between colleges also make comparison based on IPEDS difficult. We present the revenue trends as an estimate derived from tuition rates and various discounts. The chart below shows that the ‘Big 3’ have enjoyed financial success while PASSHE and the community colleges have stagnated.

These are estimates of undergraduate program tuition revenues only. Graduate, housing and ancillary revenues are excluded. The PASSHE revenues presented earlier are based on system financial reports and include housing, ancillary and graduate program revenues.

The ‘Big 3’ also have sizable revenue streams from sources other than their undergraduate programs. (Temple is almost more a hospital system with a side business in education. Penn State also has large non-educational revenues as well as a significant undergrad branch network.) Because community colleges have a more variable cost structure than 4-year residential schools, they experienced limited budget problems in comparison to a more rigid PASSHE cost structure.

So the PASSHE story can be reduced to that most basic template of business troubles: an undifferentiated product, declining numbers of customers and a high fixed-cost base. Large colleges with a substantial public presence and community colleges with a highly variable cost base can avoid these pressures. But PASSHE has none of these advantages or flexibility and managing the schools and the network will be an outright turnaround challenge.