Retention: Large Western Public Universities – which are the most successful?

Our retention survey continues with the west’s big public universities, ex-California

How do we know whether a college is running an effective undergraduate program? Retention – the % of first-year students returning for a second – offers an up-to-date metric. While it isn’t the be-all-and-end-all - other measures and information are important in “grading a program” - retention offers a bottom-line result measuring whether students can do the course work, can afford to pay for the program and, finally, like what they are getting from the college. Because retention at different classes of institutions isn’t comparable, this series tries to decompose what retention is telling us about schools in a given category and region to allow for valid lessons.

In our look at programs in Oregon and Washington, we’d highlighted the fact that the University of Washington’s main campus in Seattle appeared to be the most successful program in the Pacific Northwest. But were we comparing UW to the right peers? This post will look at the region stretching from Washington down to Arizona, skipping California’s unique higher ed ecosystem, to put the performance of UW and other large public institutions in context.

Let’s start by comparing retention and admissions for the entire set of schools. We’ll then focus in and break down this large plot to tease out some lessons.

Readers of the e-mail can click on charts to see them magnified.

Washington continues to shine. The only school admitting fewer than half of its applicants, it retains a very high number of its new students. It’s fair to call UW a regional leader.

College searches in the west outside of California remain an easy lift for applicants. Solid students can generally pick a school and, with a focused application process, feel confident they will be able to go there.

Two institutions post disappointing results: Utah State in Logan, and the University of Montana in Missoula, both with retention stats below the average for US 4-year schools. Montana as well as the University of Wyoming are flirting with being essentially open-admissions schools. Utah State’s admit rate is more stable, hovering around 90%.

What exactly is the process for a state flagship university to throw up its hands, halt its application process and admit publicly they’ll enroll all comers? Is that feasible in terms of public relations? Montana and Wyoming are two universities to track if you are interested in the question.

Arizona, Vegas and SoCal

The territory covered here is vast so looking at it in regional terms can provide some context. One of the region’s key recruiting zones is Southern California, Arizona and Nevada. Universities in the two neighboring states serve as a “release valve” for California’s competitive college enrollment marketplace. How do these schools stack up versus the big southern California programs?

This chart likely comes as no surprise for many readers: the UC/CSU campuses are more desirable. UNLV and Northern Arizona are lightly selective with quite mediocre retention stats. The one outlier here is Arizona State. ASU is less selective than either UNLV or Northern Arizona but reports significantly better results. ASU also bests its in-state rival, the University of Arizona, and does so meaningfully. In fact, our recent installment on California pointed to Cal Poly Pomona as an outperformer. Well, ASU has am essentially identical retention rate. Schools posting strong retention vis-à-vis admissions rates - such as Cal Poly Pomona - have been rewarded with increasing student interest, something repeatedly shown in the data. This holds true for Arizona State, notching another piece of evidence supporting the value of retention as a meaningful metric, which has been enrolling entering classes that are half again as big as they were in 2017:

As we all know, many institutions are reluctant to enlarge their student body size. ASU isn’t one of these, a philosophy which includes tolerating huge classes in popular subjects. During this surge, Arizona State has held its admit rate flat in the mid 80% range, consistent with its growth ambitions, instead of becoming more selective. As it receives more applications, it accepts more and more students. This has negatively affected its yield.

If it continues along this trajectory, Arizona State will rival several other super-size universities, such as Texas A&M and Central Florida, in terms of enrollment, all the while boasting very strong retention numbers. This is an underreported experiment: can a university maintain this level of performance while expanding to become one of the nation’s largest programs? It’s a challenge and we wish ASU luck with it.

The University of Utah

Besides Washington and Arizona State, the other star performer in the Rockies is the University of Utah in Salt Lake City. An earlier post here had pointed to details of Utah’s highly organized and successful recruiting effort, emphasizing in-person sales particularly focussed on southern California and Texas. The quality of the university’s marketing and outreach appears to be matched by its performance once students arrive on campus.

Unlike Arizona State, Utah is choosing to become more selective as it attracts student interest.

This is a dramatic turnaround in an environment where most public universities in the west are admitting a greater and greater proportion of applicants. The increase in applications to Utah has been torrid, going from just shy of 11,000 in 2015 to almost 25,000 in 2019.

On the yield front, Utah is not seeing an increase but it is managing to avoid the declining results experienced by other schools throughout the country:

It’s worth adding that the state of Utah has the most favorable demographics of any state in the US, from a higher ed standpoint, so the university is operating from a base of strength.

High retention schools in the West, including California

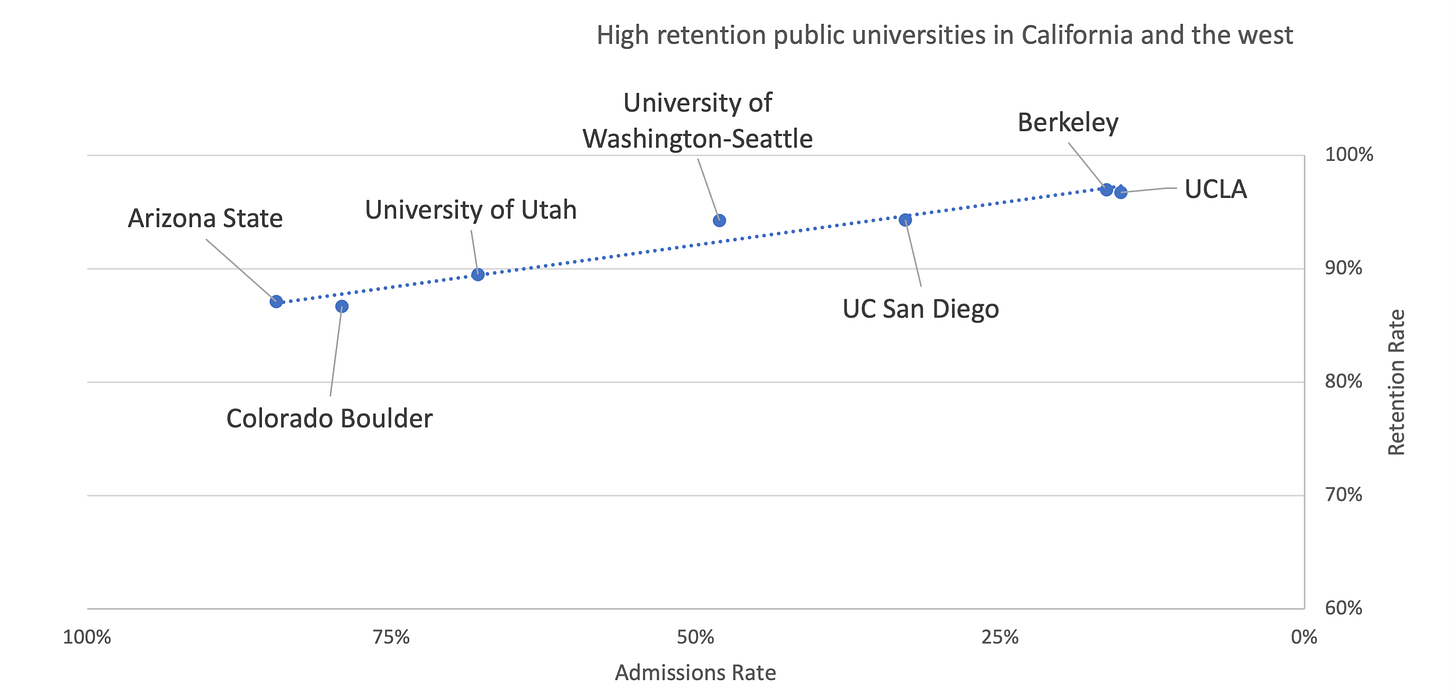

So some state flagships like Washington and Utah show strong retention stats in comparison to regional competitors. What if we only look at the region’s high-performing schools and add some strong UC campuses to the mix? Are the Washington and Utah results in line?

UW in Seattle continues to exceed expectations, even set against high-performing competition. The retention stats, if they are accurate and sustainable, indicate that Washington will take that jump in future years and show an admit rate in the 25-35% rate. It is an excellent “value play” for undergrad. We will at a later date compare some “elite flagship” stats from across the nation to gain some more perspective on where UW stands.

Arizona State is included to see if it stacks up. This is one of the more surprising results so far in this effort. ASU is perfectly in line with high-performing undergrad programs and it bests – slightly – the popular Boulder program. Given the difficult California admissions climate, ASU is establishing itself as a very viable alternative for many Golden State high schoolers and charges an out-of-state net cost in the $39-43k region, competitive with in-state options.

Utah’s admit rate has been dropping quickly and we expect Arizona State, if it chooses to cap growth, to follow suit as word of the program’s performance circulates. Retention for both universities should rise into the 90-95% range as applicant strength and popularity increases. With success comes greater expectations.

The University of Oregon (in Eugene) posts retention metrics that are very close to the high performers in the chart below. A solid honorable mention.

The recent decision by the UC system to cap out-of-state US and international enrollment across its network will help these high-performing Rocky Mountain public universities. While they don’t have the California appeal, many of them are located in beautiful areas and, for nonresidents, are much cheaper than the California options.

Before turning back to the Pacific for a look at California’s private schools, we will next turn to the embattled squadron of private colleges, many of them small and facing economic challenges, in the Great Plains.

Find more information at the CTAS site. CTAS provides data, reports and personalized assistance with college pricing and aid appeals.