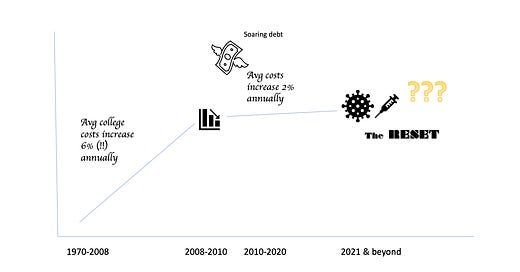

The flight control dials are swirling amid COVID’s chaotic wake. Given that it’s so hard to see where we and higher ed are going, this is a good time to step back and look at the long term trajectory of college costs. We’ll channel Scott Galloway with this chart:

After rising quickly for 40 years, college costs hit a wall with the Great Recession. That downturn induced a painful reset for students and schools alike, with the threat of unrepayable debt loads hanging over graduates and a new era of constrained pricing restricting colleges. In the last decade, the average amount a student paid per year stopped growing even as fast as inflation (and individual colleges couldn’t raise prices even at that low rate).* With COVID receding, different indicators are pointing in different directions as a historically stable industry waits for another reset, a new normalcy to emerge. The high level of uncertainty makes setting out some big drivers and tracking them better than pretending to know what will come.

*The 2% inflation rate shown above is, to be specific, the increase in how much the average US undergrad spent on college in the academic year. There is a “mix” component to this increase, because the number of students enrolling in different schools changes. Individual schools themselves were able to raise their prices on average by just 1% annually, with the other 1% in the 2% inflation coming from the shift in spending to more expensive alternatives. Students generally upgraded to more expensive options in this time: larger schools instead of smaller ones and 4-year programs instead of community colleges. Prices are measured through Average Net Cost.

Forget where we’re going, we don’t even know where we are

It isn’t just the future that is cloudy, but also the recent past. Full data for the 2019 enrollment cycle onwards has not arrived yet, so we don’t know what exactly has happened for three highly unusual years:

2019 wasn’t normal? No, not at all. US workers saw their biggest raises in decades. Family income from wages soared 8% that year, an increase enjoyed by workers across the economic spectrum. We are still waiting for the data to see how colleges did this cycle: did they respond to the surge in incomes by increasing prices? Or did college affordability improve as their prices rose more slowly than incomes?

2020: COVID. No explanation needed.

2021: COVID, test optional, massive application surges at certain schools and the first year where the NACAC DoJ consent decree was operative in a non-crisis environment.

In 2018, for example, you could be reasonably confident what the 2015, 2016 and 2017 higher ed landscape looked like even before all the data was in. We are not in that position today with respect to the last three years, making the future even cloudier.

Three important drivers

Moving on to “things to watch.”

Family income, with the mass unemployment of last year and the trillions of dollars of government stimulus, is a total wild card at this moment.

The 2010s were marked by undergrad Net Costs hewing closely to the family income of college grads.

Our preferred index for understanding college pricing in the 2010s is a US Census Family median income measure for the subset of families with at least one parent over the age of 25 holding a Bachelor’s. Correlations and statistical quality tests for Family income of all types were strong, supporting the importance of this class of macroeconomic metric to higher ed. Family incomes drove what college could charge in the last 10 years.

US personal and family income measurements are going bonkers right now, with job losses, economic dislocation and mountains of cash being “helicopter dropped” by the government and Federal Reserve to people and the financial markets. How will it feed into college pricing? A total mystery.

Overcapacity everywhere: There are too many college seats. By our count, ten flagship schools didn’t hit their enrollment quota on time this year; and the travails of many private colleges are well-known to readers. In the coming decade, with stagnant high school graduating classes (stagnant - not declining), 2020/21 falls in enrollment being confirmed with more data, and a mediocre outlook for international students, who will fill these spots?

Highly selective schools have obviously done very well in 2021 and should continue to thrive while open enrollment schools are seeing disappointing levels of student interest.

Schools in between will be the ones to watch for emerging trends on pricing, enrollment and admissions. How far up the selectivity rankings will enrollment issues and price pressure extend? Privates like Villanova (29% acceptance rate in 2018), University of Miami (32%) and Boston College (28%) could serve as bellwethers. All were forced to aggressively increase their financial aid in the most recent cycles where we have data, all recruit nationally (so won’t simply be affected by a region’s trends) and all will fill their seats - the question is what the admissions offers will look like.

Online: niche product or the future? Difficult to predict but two metrics will likely be important:

% of US undergrads only enrolled in online classes. This proportion had been creeping up in the last part of the 2010s. Hybrid in-person/online looks to become widespread after the pandemic but “some” (the word in the IPEDS survey) isn’t a number so we can’t track the exact proportion of hybrid classes. The proportion of students fully online is one measure that is tracked but it’s a minority of students and a tiny proportion of “prime age” (<25) students. Still, important and useful.

Western Governors enrollment and student success metrics. If the retention rates they are reporting are real, and not the results of the tiny sample size used, this is an important development as it would mark a national online using a novel program practice to achieve results in line with 4-year in-person results. (See towards the end of this post.)

Online education’s market share affects overcapacity and pricing.

Overcapacity: online students can be added for a much lower marginal cost than in traditional in-person. Rice and a few other schools have received attention for expanding their class sizes, but those increases are dwarfed by the enrollment increases seen at SNHU and Western Governor’s on a routine basis. So online can rapidly scale up, leading to a condition of permanent overcapacity across higher ed. Selectivity and enrollment management may already be zombie artifacts of a physical, in-person educational model.

Pricing: Almost all of the national onlines have easy-to-understand, near-fixed pricing. Go on their websites and you will quickly know within a few hundred dollars how much it will cost to attend. Now all of these schools are also open enrollment which requires near-fixed pricing, but the complex pricing discrimination currently practiced by traditional schools may in a basic way be mismatched with online educational delivery. This will all be very interesting to follow, and will influence college costs.

Family income, overcapacity and online learning; there are other important stories developing but these three are all vital and will help set the next higher ed equilibrium, the new normal.

You can also find this piece and others at the CTAS website.